What is the meaning Perpetual Inventory system?

Perpetual inventory is basically known as the continuous accounting practice which records inventory changes in a real-time. without any of physical inventory, so that you book a inventory that can accurately show a real stock. Warehouses which register a perpetual inventories using a input devices such as known as point of sale systems and a scanners.

The use of perpetual inventory methods has been increased in warehouses and even in the retail industry. With perpetual inventory, overstatements, also known as phantom inventory, and missing inventory understatements can be maintained to a minimum. Perpetual inventory is also a need for companies using a material requirement planning (MRP) system for production.

What is the Perpetual Inventory System?

It can continuously use the perpetual inventory system to estimate your inventories based on your specialized records as not in a physical inventory. They can start this system with the baseline from a physical count and updates based on purchases made and shipments made out.

Mr. Max Muller known as The President of Max Muller and Associates LLC and a Author of book of “Essentials of Inventory Management,” mainly says, “Perpetual inventory management systems can keep track of real-time. It can use it in the software for following the rules by keeping the system complete, and it also works great.

I will recommend doing 3D-counting, where you can count cross-sections often on account enough for the whole over time. You can also consider this perpetual, but it would need to be driven by software and follow various rules or do a certain variation.”

What is the Inventory Management System?

Inventory management software and a processes are been allowed for real-time by mainly updating the inventory count. It also means the employees can use barcode scanners for recording sales, recording purchases, or recording the returns they have happened. Employees can even feed this information into a continually adjusted database that can track each change made. Updating the inventory automatically or perpetually can give the system its name and differentiates it from the systematic approach.

There are advances in inventory management software in past years. It integrates it with several other business systems that have made perpetual inventory an even more practical and powerful option for many businesses. Additionally, inventory management systems that have been cloud-based can often be a real-time key element for the perpetual inventory system.

The total amount of perpetual inventory software usually comes from its ability to integrate with other business systems. For instance, real-time inventory information can be vital for the financial and even accounting teams. Inventory can also make up a huge part of your stated assets, so in this case, integrating inventory management with financial systems can help to ensure accurate tax and regulatory reporting.

While having access to real-time data, salespeople can also provide accurate shipping data, manage expectations, and even provide a better customer experience that can directly impact your reputation. Integration of the inventory software with marketing systems helps provide the team with current knowledge of selling and not.

Marketers can also set current information in the context of historical trends to understand customer behaviour and a position a company is to meet an anticipated customer in demand. This will improve your inventory turnover ratio.

What Is the known as Periodic Inventory System?

Mainly periodic inventory system, also known as the non-continuous system, is a method that companies usually use for accounting for their products. According to a specified accounting period, periodic inventory does not keep an ongoing tally of goods, purchases, sales, and associated costs.

This system usually works with the company’s accountant, which records all purchases into a purchase account. The company can also count the physical inventory and the accountant shifts and any related balances into the inventory account. Next, the accountant can also adjust the inventory account for matching the cost of the ending inventory. A hallmark of a periodic system is considered as the physical count of goods.

This number can also be critical since the company does not track some unique transactions. Whether the company is performing it weekly, monthly, quarterly, or annually, this inventory kicks off the records reconciliation.

In a periodic system, companies can calculate the Cost of Goods Sold directly after the physical inventories. They are not keeping it on a spinning basis, nor do to get it update it continuously after each and every transaction. They are not keeping an inventory account in a periodic system since they debit all purchases to a purchase account.

Once the period is completed, the company adds the purchase account totals in the inventory’s beginning balance. Then, the company can compute the cost of goods available for sale for the new period.

Perpetual system vs. Periodic Inventory Systems:

Perpetual systems and periodic systems require different tools and procedures to document inventories, although they can be complementary. In a perpetual system, employees can also track all the products all the time. In a periodic system, employees can even record products only at specific intervals.

A perpetual system can be more complex than periodic systems, as there are even more records for the software and employees for maintenance. Mr. Muller also suggests that “When considering the system that you want to use, the fundamentals are the same— regardless of your approach. Even with the most advanced software, you are just speeding up your mistakes if there is a disconnect within the whole system.

You would be able to make decisions about the system based on the nature of your products, their perishability, and even their physical handling: whether they are huge or small, and even how much space they are consuming. The nature of the product can also be dependent on how your company is receiving and making stock of it. Some goods are even unitized means that they have small parts and are also broken up into individual bins.

Mr. Muller also shares an example: “Years ago, when I worked with a company that was having no experience with frozen chicken. When they were checking in, they would unload the chicken on the hot dock. As a result, even though it was still safe to eat, it usually becomes very unsightly after cooked.

After that, they learned to bring the stock into the freezer and then check in to their stock. This will improve your inventory turnover ratio. They also have to adjust their procedures and systems completely based on their needs of products.”

Some Additional differences of inventory perpetual systems and periodic inventory systems:

Update your Accounts: In a perpetual system, updating to the general ledger and inventory ledger can be continuous with every transaction. In a periodic system, the updates to the general ledger can only occur when there is a physical count which is not based upon transaction.

Calculating Cost of Goods Sold:

Under a perpetual system, the software system maintains a running tally of transactions to provide the cost of goods sold. A periodic inventory system can calculate the cost of goods sold after conducting a physical inventory in a lump sum at the ending of the accounting period. It is impossible to calculate a precise cost of goods sold before the accounting period ends.

Recording Transactions:

In a perpetual system, it is impossible to maintain records manually because several thousands of transactions are to be tracked; a perpetual inventory system also requires software. However, a periodic system does not require software. You can manually track down your inventory in a periodic inventory system.

Cycle Counting:

Cycle counting is done when businesses count portions of their inventories with the intent of completing a full inventory over a complete-time cycle. They don’t count their entire inventory at once, but they make small adjustments based on their count. It is also called sampling, businesses which are only used cycle counting in a perpetual system. They don’t use cycle counting under a periodic inventory system because they cannot set a baseline.

Recording Purchases:

You record purchases in the raw materials inventory account or the merchandise account in a perpetual system. In a periodic system, you can log purchases into the purchases asset account without the addition of any information of unit count.

Performing Investigations:

In a perpetual system, transactions can be available at a very detailed level. As such, you can also conduct investigations easily into inventory-related errors. These investigations are more complicated in a periodic system because the system aggregates data at a very high level. It is also difficult to use this data for pinpointing errors in the process.

Even though generally accepted accounting principles standards say that either perpetual systems or periodic systems are appropriate for any business, each is more suitable for different-sized organizations. Overall, perpetual systems can be more suited to higher sales volume or multiple retailing locations because it is considered a timelier system.

Periodic systems can also hinder decision-making for these kinds of organizations. Periodic systems can be more suitable for businesses that are not affected by slow inventory updates. These include emerging businesses that offer services or companies with low sales volume and easy-to-track inventory.

For instance, companies whose staff are struggling with a perpetual system, particularly those with seasonal help, will also receive benefits by maintaining a periodic system. As their businesses are growing, they can always institute perpetual inventory.

Normally not everyone agrees that it is wise to use periodic systems when you do not have many products. Muller echoes the sentiment that: “Periodic inventory systems can be terrible. During the annual inventory, you can also go out and do a counting.

There are excellent chances that the paper life of the item is not going to match its real-life. So, you might be having a disconnect. If you are only taking inventories once a year, you might not know when the disconnection will happen. There are many issues which are between the start and at the end of a product’s life; there is no other type of way to find the errors in a known periodic system.

We should be able to reverse back and find items right after problems happen to help improve inventories. Companies can correct records and even fix imbalances and move on ahead in a snap of a time. Almost immediately, the problems can reassert themselves.

It is important to perform this exercise for accounting purposes unless you have a mature cycle count program. Auditors would also take a mature cycle and count program as an annual physical count.

Various Advantages and Disadvantages of Perpetual Inventory system:

Perpetual inventory also allows for even more real-time inventory tracking by making it superior to other methods. However, the system may require consistent record-keeping and monitoring, and it is more expensive for setting up than other methods.

Perpetual inventory can also save your money in these ways:

There is also no need for closing the facilities regularly for performing physical inventories,

Data by scanning barcodes can help you forecast stock,

You can also account for all transactions by providing complete accountability for your various products.

As it is considered that the perpetual inventory is superior, it is not necessary to be perfect. As there is a constant, automatic product tracking system, there are various ways for losing control over positive inventory.

Several disadvantages of using perpetual inventory include:

You might have to perform an annual inventory for synchronizing your data,

You must have to input every transaction, which usually requires more consistent record-keeping and even monitoring,

Perpetual inventory systems also have higher setups that cost more than other methods since they may require software and training.

Usage of Perpetual Inventory System?

Large businesses that had enormous quantities of inventory favors perpetual inventory systems. Ideally, perpetual inventory systems can be emerged and also, it is also small to medium-sized businesses looking for scalability.

Huge businesses are having difficulty in performing the cycle counts that are much necessary for a periodic system. Further, an organization with several retail locations might find it easier to controlling inventory when there is a regularly updated database of products.

E.g., a tool retailer with a customer looking for a specific wrench can be rarely requested and sold. It is having six locations in the local area. Using a perpetual system, it also has real-time information about which site may have one in stock so the customer can get his wrench quickly instead of visiting a store to store looking for it.

Other businesses that need a perpetual inventory include those specializing in shipping drop, where the manufacturers are shipping directly to the customers or specializing in trading and distribution. In these businesses, the inventory can always be on the move. Also, there can be constant returns and various exchanges. It is necessary to understand that which stock is available at a given time always requires constant updates or even a perpetual system.

When can you use a Perpetual Inventory System?

Perpetual inventory systems can be helpful for those who are always needed for understanding margins and profitability. A large business are having many type of products or a company has been scaled an emerging business over a period of time would be used a system of perpetual inventory system.

Experts usually think that perpetual inventory systems can be the future, especially for product companies. They are getting cheaper and even more accessible for even small businesses to acquire and use. Muller also explains that “The future of industry is mainly leaning towards more than a real-time of identification of a products and by improving everything.

That is having to do with transmitters in and on a products. It can be an automatic form of identification. It does not matter that where you are storing it; you can find it.”

A perpetual inventory system can change software records into a sales revenue account every time when the company makes a sale or any purchases of new inventory. This process used for recording sales can be ensured that the accounting records can be reflected accurate balances in the accounts affected. The software can also record the price which is charged.

For recording transactions in a perpetual system, you might know the selling price, purchase price, and accounts affected. The selling price is what the customer is paying for the item. The purchase price can be associated with the product, including the shipping, receiving, and costs of storage.

A typical journal entry would also show which account the software debited and which account the software credited for each transaction.

How Are Inventories are tracked under a Perpetual Inventory System?

A perpetual inventory system can track goods by updating the product database when there is a transaction, or a sale or a receipt, which has happened. Every product is assigned for tracking code, such as a barcode or RFID code that distinguishes it and tracks its quantity, location, and other relevant details.

When new products are entering a business, employees can scan them. Without a computerized inventory system, it would not be easy to track every transaction manually, especially in companies selling many products.

E.g., a big retail box store is having thousands of products. Its supply chain is providing deliveries daily of additional goods that the employees can scan into their database. If the product is new, then the employee must add all the detail of the product when can initially scan them. It includes that additional information in a description, the product code or even SKU, and where all the customers will find it in the store.

If the store is already carrying the product, this scan can update the quantity already in stock. When a customer purchases a product, the database lists one product less in its count. Any time, the store manager might review the database to learn how much of that product is currently available in stock and whether they might need to order more.

This system also depends on the proper procedure of inventory control. E.g., promptly, the system needs to be ensured that the employees can scan any new inventory. The database can reconcile physical counts, which is rare, but it is quite necessary since a true as known as inventory count can become tilted over time with loss, theft, or even breakage.

Formulas included in Perpetual Inventory:

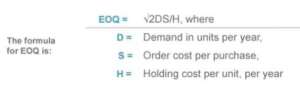

Inventory management formulas can indicate when to order more inventory, how much is needed to order a lead time required before placing an inventory order. How much stock you need to keep safe.

Economic Order Quantity usually considers how much it will be costs for storing the goods alongside the actual cost of the goods. These results dictate that the optimal type of amount of an inventory to basically buy or to make and minimize expenses.

The (COGS) Cost of Goods Sold in inventory management system

When you are selling a products in type of perpetual inventory system. The expense account will increases and will grows sales costs, also called the cost of goods sold; sales costs are the direct expenses from producing goods during a specific period. These costs also include the labour and costs of materials but leave off any distribution or cost of sales.

You calculate the beginning inventory as whatever stock remains from the previous period if you do not have an actual beginning inventory. The accounting period could be in months, quarters, or even in a calendar year. The COGS in a perpetual system was rolling and even recalculated after every transaction, but you can also use the COGS formula for calculating it for a period.

Let’s say Aviara, a product manager, wants to know that if she is pricing generic Acetaminophen, which is high enough for leaving a healthy profit margin. COGS is considered an effective formula for setting up prices on various manufactured goods. If she is calculating the COGS as 10 USD per 100-capsule bottle, she will need to price each bottle higher than 10 USD so that her company can comfortably earn a profit.

Aviara’s business uses the calendar year, which starts on Jan. 1 and ends on Dec. 31, for recording inventory. The company accountant has valued the Jan. 1 beginning inventory of generic Acetaminophen at 49,000 USD, or 4,900 bottles. During the year, the generic Acetaminophen costs the company 40,000 USD for materials and also on labor. On Dec. 31, the company’s accountant can value the ending inventory at 30,000 USD.

Gross Profit:

Aviara can use the figure that she can calculate for COGS for making decisions about the product.

E.g., she can use COGS to calculate the gross profit of her company made from generic Acetaminophen. Gross profit can come simply from the product revenue minus COGS.

If Aviara needs to increase the product cost to make more profit or lower the cost for making it more competitive in the marketplace, now she knows how it will affect her company’s bottom line.

Gross Profit Method:

In a perpetual system, you might sometimes need to estimate the amount of ending inventory when preparing financial statements or destroying the stock for calculating this estimate, starting with the beginning inventories and costs of purchasing during that period.

Let’s say that we might need to estimate the ending inventory from the current month. The values you needed to know for calculating this are the gross profit as a sales percentage, the total sales for the period, the beginning inventory for the period, and even purchases for the period.

As mentioned, estimate the relative percentages of COGS and gross profit for your total sales. From there, solve the cost of goods sold, and then complete it with the known values minus COGS. The result should be providing an ending inventory estimate and claim as the bottom-line figure for this period.

Explain the First In First Out Perpetual Inventory Method?

FIFO is the cost flow assumption that businesses usually use for valuing their stock, where the first items have placed in inventory are the first items that are sold. So those inventories which are left at the end of the period are the most recently purchased or produced inventory.

A cost flow assumption concept of an inventory accounting method used for the original valuing of the products from the beginning of the inventory of a period and purchase of new inventory for calculating the value of the inventory at the ending and the cost of goods sold. The three cost flow assumes that businesses used for this are First In First Out, Last In First Out and even the Weighted Average Cost.

Explain the Last In First Out Perpetual Inventory Method?

LIFO is a cost flow assumption that most businesses use for valuing their stock where the last items that have been placed in the inventory are the first items sold. So the inventories that remained at the end of the period are considered the oldest purchased or produced. In a perpetual LIFO system, the final costs available at time of a sale first product of software moves from inventory account and it get debits from COGS account.

Explain the Weighted Average Cost Perpetual Inventory Method?

The Weighted Average Cost is the cost flow assumption of businesses that is used for valuing their inventory. Weighted Average Cost is the average cost of goods that are sold for all the inventory. It is also called the moving average cost method; accountants perform this differently in a perpetual system than a periodic system.

The goal of using the weighted average cost is to give every inventory item a particular standard average price when you are making a sale or purchase. In a perpetual system, you would not be calculating the weighted average cost by using a formula for a specific period. You can also use weighted average cost for calculating an average unit cost, COGS for a period, and ending inventory for a period.

My Name is Nadeem Shaikh the founder of nadeemacademy.com. I am a Qualified Chartered Accountant, B. com and M.Com. having professional and specialize experience in field of Account, Finance, and Taxation. Total experience of 20 years in providing businesses solution in Taxation, Accounting, and Finance with all statutory compliance with timely business performance Financials reports. You can contact me on nadeemacademy2@gmail.com or contact@nadeemacademy.com.