INTRODUCTION IND AS 10

No company can show the details on the same day as the day of reporting. There would be always a distance between the end of the period for which financial statements have been presented and the date on which the same will be made available.

During this gap, there is a chance of few events that will have far-reaching effects on the business or existence of the company.

Now here one question arises: What could be the view of the company that it should take about such events? Should it be leaving it without any cognizance as they are taking place after the reporting period, or should it take awareness of such events as preparing the financial statement and making it available to the public? If the company is aware of the facts and is still not showing the same, then it may mislead the users. Ind AS usually deals with such events and guides its treatment in the financial statements.

OBJECTIVE of IND AS 10

The objective of this Standard is prescribed below:

- When an entity should regulate its financial statements for the events after the period of reporting.

- The revelation that an entity should give about the date when the financial statements were approved and about events after the reporting period.

The Standard also requires that an entity is not preparing its financial statements on the basis of going concern, if events after the reporting period indicate that the going concern assumption is no longer appropriate.

SCOPE IND AS 10

The Standard -shall be applied in:

Accounting for events after reporting period.

Disclosure of events after the reporting period.

DEFINITIONS AND EXPLANATIONS IND AS 10

We have seen above that the main focus of the Standard is events after the reporting period. Therefore, it is necessary to understand its meaning.

Events after the Reporting Period:

Events after the period of reporting are those events, which can be favourable and unfavourable, that can also occur between the end of the reporting period and the date when the financial statements in case of a company have been approved by the Board of Directors and in any other case of any other entity by the corresponding approval from the authority for the issue.

Approval of Financial statements:

Now the question arises that what is meant by approval of financial statements? When can one say that the financial statements are approved? Which body needs to be considered as approving authority? If there is a hierarchy of approvals, at what level one can assume that the financial statements are approved?

What is the date of approval of financial statements?

It is worthwhile to note that the process involved in approving the financial statements for the issue will vary depending upon the (a) management structure, (b) statutory requirements and (c) procedures followed in preparing and finalizing the financial statements.

(i) In case of a company: The financial statements will be treated as approved when the Board of directors approves the same.

(ii) In any other case of any entity: The financial statements. will be treated as approved when the corresponding approving authority approves the same. The Standard does not mention specifically what will constitute the approving authority in case of any other entity.

But from the word, “Corresponding” one can construe that it is the body authorized to manage the entity on behalf of all members.

It is relevant to note that in some cases, an entity is needed to submit its financial statements to its shareholders for the approval after the Board have approved the financial statements for the issue. In such cases, as per paragraph 5 of Ind AS 10, even though shareholders’ approval is needed yet, to decide the events after the reporting period, the date of approval of financial statements will be considered the date of approval by the Board of directors only.

Likewise, in some other cases, the management of an entity is needed to issue its financial statements to the board of supervisory which are made up solely of non-executives for various approval. In such cases, the financial statements have been approved for issuing when the management approves them for the issue to the supervisory board.

When the date of approval is after the public announcement of some other financial information:

‘Events after the reporting period’ include all events up to the date when the financial statements are approved for the issue, even if those events occur after the public announcement of profit or other selected financial information.

Should the company report only unfavourable events?

The Standard clearly states that events after reporting period can be favourable as well as unfavourable. Accordingly, an entity should report both favourable as well as unfavourable events after the reporting period.

TYPES OF EVENT IND AS 10

The events after the reporting period’ are classified into two categories:

(i) Adjusting Events: Adjusting events are those that are providing evidence of conditions that are existed at the end of the period of reporting (adjusting events after the period of reporting).

(ii) Non Adjusting Events: Non-adjusting events are those that are indicative of situations that are arising after the period of reporting (non-adjusting events after the reporting period).

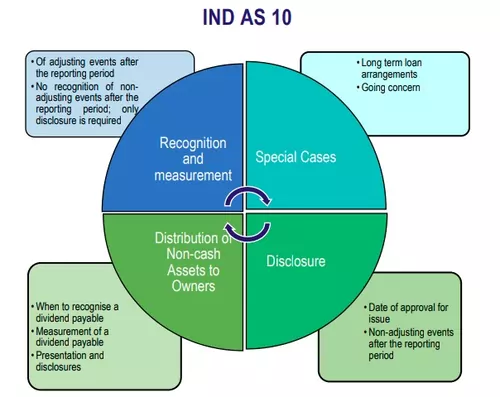

RECOGNITION AND MEASUREMENT OF ADJUSTING EVENTS

An entity should adjust the amounts which are recognized in its financial statements to reflect adjusting events after the reporting period.

ACCOUNTING TREATMENT AND DISCLOSURE OF NON- ADJUSTING EVENTS AFTER THE PERIOD OF REPORTING

A case of a non-adjusting event after the reporting period is a decline in the true amount of investments between the end of the period of reporting and when the financial statements have been approved for issue. The reduction in fair value normally does not relate to the condition of the investments at the end of the period of reporting but it reflects circumstances that have subsequently arisen.

Therefore, an entity is not able to adjust the amounts which are recognized in its financial statements for investment purposes. Similarly, the entity do not update the amount which is disclosed for the investments at the end of the period of reporting, although it may need to give additional disclosure as required.

SPECIAL CASES in IND AS 10

Long-term Loan Arrangements:

Notwithstanding anything contained in the definition of adjusting events and events which cannot be adjusted, where there is a breaking of a material provision.

An arrangement of a long-term loan on or before the end of the period of reporting period with the effect that the liability can become payable on demand on the reporting date, the agreement by a lender before the approval of the financial statements for the issue, as a consequence of the breach demand of payment should not be done, shall be considered as an adjusting event.

Going concerned in IND AS 10:

- An entity shouldn’t prepare its financial statements on a going concern basis if management determines after the reporting period that is intended for liquidating the entity or cease trading or that it is having no realistic substitute but to do so.

- Decline in operating results and financial position after the period of reporting might indicate a need for considering whether the going concern assumption is still appropriate. Suppose the going concern assumption is no longer appropriate. In that case, the effect is so prevalent that this Standard needs a fundamental change in the basis of accounting, rather than making an adjustment to the amounts recognized within the original basis of accounting.

- Ind AS 1 specifies the required disclosures below:

(a) The financial statements aren’t prepared on a going concern basis.

(b) Management is aware of uncertainties of material which are related to events or conditions that may be casting significantly doubting upon the entity’s ability for continuing as a going concern. The events or conditions are required disclosure may arise after the reporting period.

Going concern approach has a lot of importance in the financial statements. Going concern approach can be applied if and only if the entity has intentions to continue its operations. The carrying amount of assets and liabilities will be much different if the entity has plans to go in for liquidation.

Suppose a company decides to go into liquidation. In that case, the company’s long-term liabilities will turn into short-term liabilities as the company will have to pay all its debts before it closes down its operations. Thus, the overall approach of accounting will change when there is no going concern approach.

Therefore, Ind AS 10 specifically requires that if after the reporting period but before approval of the financial statements, there are any signs of not continuing the operations or the decision is taken during that period not to continue with the operations, even though the decision was taken after the reporting period. Still, the entity should prepare the financial statements with a different approach and inform the stakeholders clearly that it is planning to cease operations.

DIVIDENDS in IND AS 10

Financial Instruments: Presentation after the reporting period, the entity is not able to recognize those liability as a dividends at the end of the period of reporting.

- If dividends are declared after the period of reporting but before the financial statements are approved for an issue, the dividends are not recognized as a liability at the end of the reporting period because no obligation exists at that time. Such dividends are disclosed in the notes following Ind AS 1, Presentation of Financial Statements.

- The crux of the difference between adjusting event and non-adjusting event depends on whether the event provides evidence for the existence of a condition at the end of the reporting period.

My Name is Nadeem Shaikh the founder of nadeemacademy.com. I am a Qualified Chartered Accountant, B. com and M.Com. having professional and specialize experience in field of Account, Finance, and Taxation. Total experience of 20 years in providing businesses solution in Taxation, Accounting, and Finance with all statutory compliance with timely business performance Financials reports. You can contact me on nadeemacademy2@gmail.com or contact@nadeemacademy.com.