What is classified Balance Sheet ?

The balance sheet is reviewed as one of the three major fundamental financial statements and is key to financial modeling and accounting. The balance sheet also displays the company’s total assets and how the assets have been financed, either through debt or either through equity. It can also be referred as a statement of net worth or a statement of financial position.

As such, the balance sheet has been divided into two sides (or sections). The left side of the balance sheet shows all of a company’s assets. On the right side, the balance sheet all of the company’s liabilities and shareholders’ equity.

The formula which is used for a balance sheet

Assets = Liability + Shareholder’s Equity

Usually, the balance sheet mainly adheres to the following accounting equation, where as assets on one side and a liabilities plus shareholders’ equity on the other balance out:

This formula is a intuitive: a company has to mainly pay for all the things it owns (assets) by either a borrowing money (taking on liabilities) or taking it from investors (issuing shareholders’ equity).

For e.g., if a company is taking out a five-year, 4,000 USD loan from a bank. Its assets (specifically, a the cash account) will be increase by 4,000 USD. Its a liabilities (specifically, as the long-term debt account) will also be increase by 4,000 USD, balancing the two sides of the equation.

If the company is taking 8,000 USD from investors, its assets would be increased by that amount, as will its shareholders equity. All revenues from the company are generated in excess of its main expenses will go into a part of shareholders’ equity account. These type of revenues will be balanced on the assets side, appearing as cash, investments, inventory, or other assets.

Assets, liabilities and shareholders’ equity each contains of several smaller accounts that would be breaking down the specifics of a company’s finances. These accounts can vary widely by industry, and the same terms could be having different implications, which mainly depends on a nature of its business. Broadly, however, there can be few common components that investors would be likely to come across.

What’s on the classified Balance Sheet ?

The balance sheet is mainly considered as a snapshot which would be represents the state of any company’s finances at the moment in time. By itself, it can’t give an understanding of the trends that are playing out for a longer period.

For this particular reason, the balance sheet should be compared with those of previous periods. Also, it should be compared with the of other businesses in the same industry. Since different industries have a unique approaches to financing.

Several other type of ratios derived from the balance sheet, helping investors understand how healthy a company is. These also include the debt-to-equity ratio and the acid-test ratio, along with many others. The income statement and cash flows also provide valuable context for assessing a company’s finances and making any notes or appendix in an earnings report that might be referring back to the balance sheet.

Assets

Within the segments of assets, accounts which are listed from top to bottom in order for their liquidity. The ease with which they would be converted into cash. They have been divided into current assets, which can also be converted to cash in less than one year, and long-term assets or non-current, which cannot.

Generally, here is the order of accounts within current assets:

Cash and cash equivalents can be the most liquid assets and could be including short-term certificates of deposit and treasury bills, as well as hard currency.

Marketable securities are those equities and debt securities for which there can be a liquid market.

Accounts receivable also refers to a money that customers have owed to the company, perhaps by including an allowance for various doubtful accounts since a certain proportion of customers could be expected for not paying.

Inventory is goods that are available for sale, valued at the lowest of the cost or market price.

Prepaid expenses also represent the value which has already been paid for, such as advertising contracts, insurance or rent.

Long-term assets which are included in the following:

Long-term investments are those securities that would not or cannot be liquidated in the upcoming year.

Generally, fixed assets also include machinery, land, equipment, buildings and other durable which are considered as a capital-intensive assets.

Intangible assets also include non-physical (but still valuable) assets such as goodwill and intellectual property. Normally, intangible assets are only listed on the balance sheet if they have been acquired rather than they are developed in-house. Thus, their value might be wildly understated – by not including a logo which is globally recognized, for example – or just as overstated wildly.

Liabilities

Liabilities are the money that a company is owing to outside parties. Bills it has to pay to a suppliers to mainly interest on bonds it has issued to creditors to rent, utilities and salaries. Current liabilities can be due within 12 months and are listed in order of their due date. Long-term liabilities can be due at any point after one year.

Current liabilities accounts might also be including:

Long-term debts current portion.

Indebtedness of Bank.

Payable Interest.

Payable wages.

Prepayments to customers.

Payable dividends and others.

Premiums which are Earned and unearned.

Accounts which are payable.

Long-term liabilities can also include:

Long-term debt: Issued interest and principal are on bonds.

Pension fund liability: The financial support a company is required for paying its employees retirement accounts.

Deferred tax liability: Taxes that have been resulted but would not be paid for another year; besides this timing, this figure also reconciles differences between financial reporting requirements and the way that tax has been assessed, such as the calculation of depreciation.

Some liabilities have been considered off the balance sheet, meaning that they will not appear on the balance sheet.

Shareholders Equity

Shareholders equity is the money that is attributable to business owners, meaning its shareholders. It is also called as “net assets” since its equivalent to the total assets of a company is deducted from its liabilities, that can be the debt it owes to non-shareholders.

Retained earnings are the net earnings of a company that is either reinvested in the business or a uses to pay off its debt. The rest can be issued to a shareholders in the form of a dividends.

Treasury stock is a stock of a company which is has repurchased. It can be sold at the later date to raise a cash or reserved to repel a hostile takeover.

Some companies can issue preferred stock, which can be listed separately from common stock under the equity of shareholders. Preferred stock can be assigned as an arbitrary par value. As is common stock, in some of a cases. That has no part of bearing on the market value of the shares (often, par value is just 0.01 USD). The “preferred stock” and “common stock” accounts have been calculated by multiplying the par value with the number of a shares that have been issued.

Additional capital surplus or paid-in-capital represents the amount shareholders have invested more than the “common stock” or “preferred stock” accounts, which is based on par value rather than market price. Shareholders equity does not been directly related to a company’s mention market capitalization. The latter it is based on the current price of any stock. While paid-in capital is the mainly sum of the equity that are been purchased at any price.

How is the Balance Sheet have been used in Financial Modelling?

This statement is a great method for analyzing a company’s financial position. Generally, an analyst can use the balance sheet for calculating many financial ratios that will help to determine that how well a company is performing, how efficient it is how liquid or solvent a company is,

Changes in balance sheet accounts can be also used to calculate cash flow in the cash flow statement. For example, a positive plant, property, and equipment change equals capital expenditure minus depreciation expense. Capital expenditure can be deliberate and included as a cash outflow under cash flow from investing in the cash flow statement if depreciation expense is known.

Importance of the Balance Sheet

The balance sheet is considered as a very important financial statement for several reasons.

It have been viewed at on its own and in conjunction with several other statements like the income statement and a cash flow statement for getting a full picture of the health of a company.

Four major financial performance metrics also includes:

Liquidity – By comparing a company’s current assets to its current liabilities it provides an image of liquidity. It is necessary current liabilities should be lower than current assets so that the company can cover its short-term obligations. The quick ratio and current ratio are examples of financial liquidity metrics.

Leverage – By looking at how a company has been financed it indicates that how much leverage it is having, which also indicates that how much financial risk the company is ready to take. Comparing debt to total capital and debt to equity are ordinary ways for assessing leverage on the balance sheet.

Efficiency – By the usage of the income statement in link with the balance sheet which makes it possible for assessing that how efficiently a company is using its assets.

For e.g., dividing revenue by the average total assets also produces the Asset Turnover Ratio for indicating that how efficiently the company is able to turn assets into revenue. Additionally, the working capital cycle also shows that how well a company is managing it is in the short term it is cash..

Return rates – The balance sheet can be used for evaluating that how well a company is able to generate returns. For e.g., dividing net income by a shareholders’ equity as a produces Return on Equity (ROE). Dividing net income by a total assets produces Return on Assets (ROA), and dividing net income by debt plus equity results in Return on Invested Capital (ROIC).

Analyzing a balance sheet with ratios

With a proper understanding of a balance sheet and its construction, we can review some techniques for analyzing the information which is contained within a balance sheet. The primary technique is financial ratio analysis.

Financial ratio analysis utilizes formulas for gaining insight into a company and its operations. For a balance sheet, by using financial ratios like the debt-to-equity ratio which can even provide a good sense of company’s financial condition. Along with its operational efficiency.

It is also a key point to keep in mind that some ratios would be needing information that are from more than one of financial statement, such as the balance sheet and the income statement.

The main ratios that is using details from a balance sheet are financial strength ratios and various activity ratios. Financial strength ratios, such as the debt-to-equity ratios and the working capital, provide information on how well will the company will be meet its obligations and how the obligations are leveraged.

It can give investors an idea of how financially stable the company is and how it finances itself. Activity ratios mainly focus on current accounts to show how well the company manages its operating cycle (receivables, inventory, and payables). These ratios can also provide insight into the company’s operational efficiency.

Limitations

The balance sheet is invaluable information for investors and analysts; however, it does have some drawbacks. Since it is just a snapshot, it can only use the difference between this point in time and another single point in the past.

Because it is unchanged, many financial ratios have drawn on data included in the balance sheet and the more dynamic income statement and cash flows for painting a fuller picture of what’s going on with a company’s business.

Different accounting ways and systems of dealing with depreciation and inventories would be also changing the figures which is posted to a balance sheet. Because of this, managers would be having some ability to game the numbers to look more favorable.

Always please pay attention to balance sheet’s footnotes to determine which systems are used in their method of accounting and look out for red flags.

What the balance sheet is used?

The balance sheet is considered as an essential tool used by executives, investors, analysts, and regulators to understand the current financial health. Generally, it is used alongside the two other types of financial statements: the income statement and the cash flow statement. Balance sheets also allow the user to get an at-a-glance view of the company’s assets and liabilities. The balance sheet can also help users answering some questions such as whether the company is having a positive net worth, enough cash and short-term assets to cover its obligations, and whether it is relatively highly indebted to its peers.

What is covered in the balance sheet?

The balance sheet includes details about a company’s assets and liabilities. Depending on the company, this also might be including short-term assets, such as accounts receivable and cash, or long-term assets, such as property, plant, and equipment (PP&E). Also, its liabilities might be including short-term obligations such as accounts wages payable and accounts payable, or a long-term liabilities such as bank loans and several other debt obligations.

Who can prepares the balance sheet?

Depending on the company, different parties may be responsible for the preparation of the balance sheet. For small privately-held businesses, the owner or company bookkeeper might prepare the balance sheet. For private firms who are not small nor even huge, they might be prepared internally and then looked over by an external accountant.

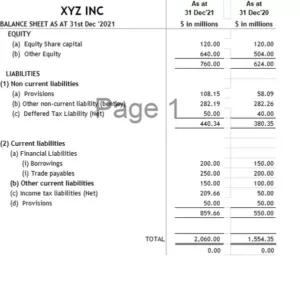

On the other hand, classified Balance Sheet public companies must be obtaining external audits by public accountants and must also be ensuring that their books are kept for a much higher standard. Balance sheet of Public companies and other financial statements must be prepared following Generally Accepted Accounting Principles (GAAP) and regularly filed with the Securities and Exchange Commission (SEC).

My Name is Nadeem Shaikh the founder of nadeemacademy.com. I am a Qualified Chartered Accountant, B. com and M.Com. having professional and specialize experience in field of Account, Finance, and Taxation. Total experience of 20 years in providing businesses solution in Taxation, Accounting, and Finance with all statutory compliance with timely business performance Financials reports. You can contact me on nadeemacademy2@gmail.com or contact@nadeemacademy.com.