What is Retained earnings ?

Preserved earnings are the advancing net earnings or revenues of a business after making up dividend payments. As an essential idea in accounting, words “preserved” captures the fact that since those earnings were not paid out to shareholders as dividends, they were rather preserved by the company.

Kept Earnings (RE) are the accumulated section of a company’s earnings that are not dispersed as rewards to investors however rather are booked for reinvestment back into the business. Typically, these funds are utilized for functioning funding and also fixed possession acquisitions (capital expenditures) or set aside for repaying financial obligation responsibilities.

For this reason, kept incomes decline when a firm either loses money or pays dividends as well as increase when brand-new earnings are developed.

Maintained incomes are the advancing net earnings or profits of a business after representing reward payments. As a vital concept in accounting, the word “maintained” catches the fact that due to the fact that those profits were not paid to investors as returns, they were rather preserved by the company.

Because of this, retained earnings reduction when a business either loses cash or pays dividends and raise when brand-new earnings are created.

Kept Earnings are reported on the balance sheet under the investor’s equity area at the end of each audit period. To compute RE, the beginning RE balance is included in the take-home pay or reduced by a bottom line and after that dividend payouts are deducted. A recap report called a statement of retained profits is also kept, detailing the adjustments in RE for a specific duration.

The Purpose of Retained Profits

Preserved earnings represent a valuable link between the income declaration as well as the annual report, as they are recorded under shareholders’ equity, which connects the two declarations. The objective of keeping these profits can be varied and consists of buying brand-new equipment as well as devices, spending on r & d, or various other activities that could possibly create growth for the business. This reinvestment into the company aims to accomplish even more incomes in the future.

If a business does not believe it can gain an adequate return on investment from those kept profits (i.e., gain more than their expense of funding), then they will certainly typically distribute those incomes to shareholders as returns or conduct a share buybacks.

What is the Preserved Earnings Solution?

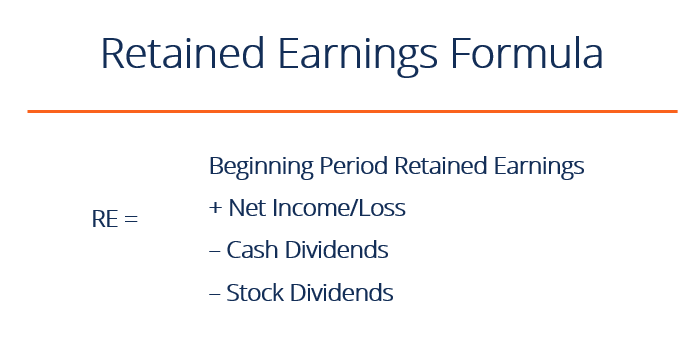

The RE formula is as follows:

RE = Start Period RE + Web Income/Loss– Cash Dividends– Stock Dividends

Where RE = Preserved Revenues

Start of Period Preserved Revenues

At the end of each accountancy period, kept incomes are reported on the annual report as the built up income from the previous year (consisting of the present year’s income), minus returns paid to investors. In the following bookkeeping cycle, the RE finishing balance from the previous audit duration will currently end up being the preserved earnings beginning balance.

The RE equilibrium might not always be a positive number, as it may mirror that the present period’s net loss is higher than that of the RE beginning equilibrium. Additionally, a big circulation of returns that surpass the maintained profits equilibrium can trigger it to go unfavorable.

How Net Income will Impacts Retained Earnings.

Any kind of changes or movement with take-home pay will straight affect the RE equilibrium. Factors such as a rise or decrease in take-home pay as well as incurrence of net loss will lead the way to either company productivity or deficiency. The Maintained Earnings account can be adverse due to huge, collective net losses. Normally, the exact same things that impact earnings affect RE.

Instances of these items include sales income, price of products sold, depreciation, and also various other overhead. Non-cash items such as write-downs or problems as well as stock-based compensation additionally impact the account.

How Dividends Impact Retained Incomes ?

Distribution of dividends to investors can be in the form of money or supply. Both forms can lower the value of RE for the business. Money rewards stand for a money discharge as well as are recorded as reductions in the money account. These decrease the size of a firm’s annual report as well as asset worth as the firm no more possesses part of its liquid properties.

Supply dividends, however, do not need a cash discharge. Rather, they reallocate a part of the RE to common stock and also extra paid-in resources accounts. This allotment does not impact the overall dimension of the business’s balance sheet, yet it does lower the value of supplies per share.

End of Period Preserved Profits

At the end of the period, you can calculate your final Preserved Earnings equilibrium for the balance sheet by taking the beginning period, including any net income or bottom line, and subtracting any type of dividends.

What Does Retained Earnings Mean?

Maintained incomes is the recurring worth of a company after its expenses have actually been paid and also dividends released to shareholders. Retained incomes stands for the quantity of value a firm has actually “saved up” each year as unspent net income. Ought to the business determine to have costs exceed revenue in a future year, the company can attract down preserved earnings to cover the shortage.

Is Income More Important than Retained Earnings?

Income and also preserved earnings have different degrees of significance depending upon what the underlying firm is attempting to attain. Revenue is exceptionally important, specifically for development firms attempt to establish themselves in a market. However, kept revenues may be a lot more crucial for companies who have actually been saving funding to deploy for resources expansion or hefty investment into business.

Retain earning Conclusion

As a firm sells products or services, it gains revenue. It uses that earnings to pay expenses as well as, if the business marketed enough goods, it makes a profit. This earnings can be brought into future durations in an accounting balance called preserved profits. While profits concentrates on the short-term profits of a firm reported on the income declaration, preserved profits of a business is reported on the annual report as the general residual worth of the firm.

My Name is Nadeem Shaikh the founder of nadeemacademy.com. I am a Qualified Chartered Accountant, B. com and M.Com. having professional and specialize experience in field of Account, Finance, and Taxation. Total experience of 20 years in providing businesses solution in Taxation, Accounting, and Finance with all statutory compliance with timely business performance Financials reports. You can contact me on nadeemacademy2@gmail.com or contact@nadeemacademy.com.