Contents

show

What is a Bankers Cheque?

The Bank guarantees a banker’s cheque that is similar to a draft. This is a banker’s cheque that has been drawn from the Bank’s funds. It is followed by a cashier signs it. These banker’s checks are used mainly for real estate payments, brokerage payments, and institutional payments. To receive the money, the beneficiary must deposit a banker’s cheque at the Bank. The cheques usually clear within one day of the deposit.

Bankers cheque Meaning

A cheque paid by a bank, rather than an ordinary cheque payable out of funds at a customer’s account. A customer can obtain a bank cheque by paying its face value. The point is that the recipient of the cheque has the assurance that it is payable by the Bank so it cannot bounce.

A banker’s check or banker’s draft is a type of cheque (or check) that allows funds to be withdrawn from the Bank’s accounts and not an individual’s.

Banker’s cheques are negotiable instruments that can be ordered and have all applicable provisions. They are valid for six months from the date of issue. In genuine cases, they may be revalidated.

Normal Banking Cheques:

A company or individual may have a checking account. They can draw cheques to transfer funds to another account. The creditor will then pass the cheque to their Bank. They will use a clearinghouse or similar system to transfer the funds from the debtor into the creditor’s account quickly. The debt is then paid off.

Bankers cheque as a reduction of risk

Normal cheques aren’t as secure as cash. If there are not enough funds to honor the cheque. A cheque sent in the mail could become worthless. The Bank or clearinghouse will then return the cheque to the creditor. They will not receive any money. Any cheque is subject to the possibility of being returned unpaid or “bounced” in the vernacular.

A person can ask for a cheque that the funds are drawn against the Bank’s funds and not one of their accounts to reduce the risk. Creditors will not be able to cash the draft if the cheque is lost or stolen.

The Bank will immediately take the draft’s value (plus any fees) from the customer’s account. To ensure that the customer has enough funds to honor the draft.

Benefits of Bankers Cheques:

1) They can be used to settle accounts with foreign partners. You can use banker’s checks to make payments for goods or services to foreign partners. To pay for books, publications, lotteries, or goods.

2) Banker’s checks are very convenient when making payments, even if there is no immediate need for money transfer.

3) It’s cheap. The cheapest international money transfer (payment) method is a banker’s check. If there is not enough information about the payee,

4) If there are not enough details about the payee, a banker’s check is the best way to make payment. When a company has provided only its name and address, it is asked to pay. International payment orders are not possible in this case in bankers cheque commonwealth bank.

The features of a Bankers Cheque

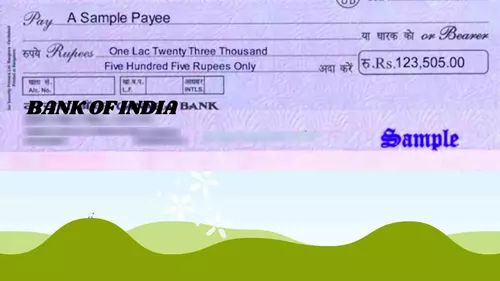

Certain features distinguish a banker’s check. It contains the Bank’s name and location (upper left-hand corner, or upper center), the payee’s names, the amount to tendered (both alphabets and numbers), and the printed signature (facsimile) of the cashier (or senior executive officer) of the Bank.

Banker’s checks also include security features like a watermark and security thread. They also have color-shifting ink, special bond paper, and security thread. These security features make it more difficult to counterfeit items.

Other features of a banker’s cheque include:

Banker’s checks are only issued for the clearing area at the Bank. You can clear it in any branch of the Bank or city, as long as it is within the local authority’s jurisdiction.

Bankers cheque validity. A banker’s check is valid for 3 months after the date it was issued.

A banker’s check cannot be dishonorable unless it is fake.

Different types of cheques in India

According to the type of account, banks offer checkbook facilities to customers. The type of account and the number of cheques available in a checkbook will also affect the number of cheques included in the checkbook. Let us now briefly explain the different types of Indian cheques.

Bearer Cheque:

You will often see printed cheque leaves with the word “bearer” on them. This indicates that the bearer can withdraw the amount. These cheques are especially vulnerable to theft, counterfeiting, and fraud. If you lose a bearer check, you could suffer financial losses.

Self cheque (for you/a a third party):

These checks can be used to withdraw money from your account. It bears the name of the account holder. Self-cheques can be encashed at the bank branch where you have an account.

A third party can also be issued self-cheques. The issuer may write “self” instead of the name of the third person. The issuer can write self on cheques, but this is not a safe option. Anyone can claim the cheque as their own, and the Bank and the issuer will not know the person’s identity who encashed it. The situation is worse if the cheque is lost or misplaced.

Pay Yourself Cheque:

These checks are crossed on to indicate that the issuer would like the Bank to take the money out of their account. Pay yourself cheques can be used to purchase bank drafts, pay orders, and fixed deposit receipts.

PDC is Post Dated Cheques. The issuer may want the cheque to be cashed at a particular time, so these cheques have a future date. These cheques can be used to make business payments or EMIs.

Local Cheque:

These checks can be presented to any bank within the city. Multicity checkbooks are quickly replacing local cheques, so they are becoming obsolete.

Multicity cheques (Outstation):

These cheques can be presented beyond the city limits. These cheques may be cashed at any branch.

At Par Cheque:

These checks are accepted in all branches of the Bank. These cheques can be used to make safe outstation payments.

Traveler’s Check:

These traveler’s checks can be used to withdraw money while you are traveling. They are an alternative to carrying cash around with you, as you can travel comfortably without carrying a lot. These cheques are accepted at foreign exchange rates. Many hotels and banks accept these cheques around the world.

Crossed cheque:

A crossed check has two parallel lines at the top left corner. This cheque is paid only to the person named on the cheque. The funds are then transferred directly to that account. Crossed cheques offer greater security than other types of cheques, as the issuer can quickly identify the account in which the funds were deposited.

Uncrossed Cheque: Cheques that do not have two parallel lines in the upper left corner of the cheque are called uncrossed. These cheques can also be called open cheques because there are no instructions for transferring funds to the payee’s accounts.

Order Cheque:

When you mark out the ‘bearer’ part of a cheque or specify the party’s name, it becomes an order cheque. Despite not having any cross’ marks, the cheque is only payable to the person or company.

Mutilated cheque:

This type of cheque is unique in the Indian financial system. Mutilated cheques are torn at certain places. Payments can only be made after the confirmation by the issuer. Mutilated cheques are usually torn in a corner that contains all required information, such as the payee’s name, amount, and signature.

How is it Different from Demand Drafts?

Real estate companies, government entities, colleges, and other large institutions won’t accept personal or general cheques from individuals or businesses to receive payments for high-value transactions. This is because the cheque could be dishonored. These institutions/ organizations require that individuals or entities attach a bankers’ cheque or demand a draft to be paid.

A banker cheque is also known as a Pay Order/banker’s draft/Teller’s cheque in the United States. It is a cheque that banks issue on behalf of customers or themselves on a prepayment basis. These cheques cannot be dishonored if they have been paid in full to the banks.

Bankers cheques can be issued to specific individuals/entities against advance payment. The applicant must pay a specified amount. Bankers cheques are valid for 3 months after issue. If they have expired, they can be revalidated.

Banker’s checks are the most secure type of cheques, as banks guarantee them. It’s a non-negotiable instrument and cannot be transferred to any person under any circumstances. A banker’s cheque cannot be canceled or stopped at any time.

When you were granted admission to the college or needed security (token cash) for the application of government/private tenders or the purchase of a new property/ apartment as a booking amount, you must have been asked to attach your banker’s cheque/demand draft.

The purpose of issuing Bankers Cheque

The banker’s cheques can be issued in two situations. The first is issued on behalf of bank customers/ applicants, while the second is used to clear the Bank’s expenses/ dues. The following are some other important circumstances where bankers may be issued.

Fixed deposits: Payment of the maturity amount

Balance amount due upon permanent closing of deposit accounts (saving/current/ OD/RD).

Rent Payments for Buildings/Spaces

Water and electricity bill payments

Third-party service providers/ agencies must be paid for their service fees.

Other maintenance and official expenses

Additionally, the banker’s check can be issued to the customer on behalf.

Payment of fees to colleges/institutions

A booking amount for apartments/ plots

As a security deposit for government/corporate tenders

To secure a deposit at auctions

Other high-value payments

The Features of a Bankers Cheque

All banker’s cheques come preprinted and are non-negotiable.

Banker cheques can’t be refunded.

You can have it revalidated if it is expired and a duplicate banker cheque issued if it is lost for nominal fees.

Locally accepted bankers cheques

Both the drawer and the payee perspectives are safe from default

Bankers Cheque Charges:

Banker’s checks can be obtained at nominal fees.

Up to Rs. 5,000/- (Rs. 25/-).

Value Rs 5,000/1000/- (Rs 50/)

Value Rs 10,000/- to one lac (Rs 6 for 1000/-, a minimum of 60/-).

A value above Rs 1 Lac (Rs 4/- per 1,000 and a minimum. Maximum Rs 2,000/- and Rs 600/-

Notice:

All charges above are inclusive of Goods & Services Taxes (GST).

Bankers cheques will not be issued without cash handling fees. Cash transactions are subject to the above charges.

Delivery of bankers cheque will incur courier charges of Rs 150/- + GST if requested online.

Additional fees of Rs. 200/- + GST is required for the issuance of duplicate banker checks and revalidation. 200/- + GST will be applicable.

There are similarities and differences between Demand Drafts and Bankers Cheque.

Both banker’s cheques (DD), and demand drafts, are drawn against advance payments and ensure payment security. However, there are two main differences. Demand drafts can be paid at different cities, while baker’s checks are only payable locally.

The banker’s check can be paid at any branch within the same city. Demand drafts, however, are available at any branch in any city.

A demand draft (DD) and Bankers Cheque are different in that they can only be issued to customers, individuals, or businesses.

There are, however, some similarities between demand drafts and bankers’ cheques.

Both of these instruments are non-negotiable and cannot be transferred to other persons/entities.

Banks issues these for customers and non-customers.

Both can be obtained against an advance payment

Both cannot be taken away.

Both instruments are valid for 3 months after the date of their issue.

There is a difference between Bankers Cheque and a Demand/bank Draft.

Sometimes, you may need to issue a demand draft (DD) for someone. You may be able to get a Banker’s cheque in certain situations.

Banker’s cheques and demand drafts are nearly the same. Both require you to pay money upfront. This can be done by taking money from your account. You might consider both to be pre-paid. The amount here is guaranteed by the Bank, unlike ordinary cheques. You don’t have to be afraid of the amount being returned.

The DD is given to someone to try to get it encashed or deposited into their account. Suppose the account is at the same branch bank (e.g., If you have a Citibank Demand Draft and the recipient has a Citibank account, it will be cleared in that branch. Finally, the Demand Draft is cleared at any branch of the issuing Bank.

The Banker’s Cheque is the same until the clearing part. The Bankers Cheque must be cleared at the branch that issued it. If the Banker’s Cheque were issued at the Bangalore branch Citibank, it would be cleared in the Bangalore branch. This is not the problem of the user. Once you have submitted the cheque, Bank will take care of it.

We can summarize that demand drafts and banker’s checks facilitate high-value transactions to reduce defaults by buyers/ drawers. This is preferred when the payee needs a 100% payment guarantee from buyers/clients. A bank guarantees future payment. A Bankers Cheque is only available against advance payment.

We hope this article answers all your questions about bankers’ cheques and their features, fees, and uses.

My Name is Nadeem Shaikh the founder of nadeemacademy.com. I am a Qualified Chartered Accountant, B. com and M.Com. having professional and specialize experience in field of Account, Finance, and Taxation. Total experience of 20 years in providing businesses solution in Taxation, Accounting, and Finance with all statutory compliance with timely business performance Financials reports. You can contact me on nadeemacademy2@gmail.com or contact@nadeemacademy.com.