What is the Debt Service coverage ratio?

The debt-service coverage ratio is applied to the corporate, government, and personal finance institutes.

According to the eyes of corporate finance, the debt-service coverage ratio is a way of measurement of a company’s available cash flow for paying the various current debt obligations.

The Debt-service coverage ratio indicates the investors whether a company has enough income to pay off its debts.

And according to the eyes of government finance, this debt service Coverage Ratio is the number of earnings from the export which is needed by a country to meet annual interest and principal payments on its various external debt.

In personal finance, it is a ratio used by bank loan officers to determine income property loans.

Understanding the debt Service coverage ratio.

The context is whether, of finance of corporate, finance of government, or personal finance, the debt-service coverage ratio will reflect the capability of service debt given by a particular level of income.

This ratio will state net operating income as various multiple debt obligations due within one year, including interest, principal, sinking funds, and even lease payments.

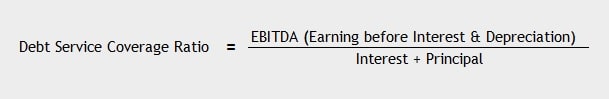

Formula and calculation of debt service coverage ratio-

The formula of the debt-service coverage ratio usually requires net operating income and the total debt servicing for the entity. Net operating income is a company’s revenue subtracted from certain operating expenses; this does not include the taxes and interest payments. It is often taken into consideration that the equivalent of earnings before interest and tax.

FORMULA:

Debt Service Coverage Ratio = EBITDA / Interest + Principal

EBITDA = Earning before Interest and Depreciation

Interest = Interest Expenses on the Debts

Principal = Principal part outstanding of Debts

Some calculations include non-operating income in earnings before interest and tax.

As a lender or even an investor is comparing different companies’ creditworthiness or a manager comparing different years or quarters, it is also important to apply consistent criteria while calculating the Debt-service coverage ratio.

If we are borrowers, it is also important to realize that the lender may calculate the Debt-service coverage ratio in slightly a different ways.

Total debt service is referred to current debt obligations. This means any interest, principal, lease payments and sinking fund due in the recent year.

On the face of the balance sheet, this will be included as short-term debt and the current portion of long-term debt.

Income taxes complicate Debt-service coverage ratio calculations because interest payments are tax-deductible, while principal repayments are not.

The below given are a formula that will help to calculate the total debt services more accurately:

TOTAL DEBT SERVICES = (Interest×(1−Tax Rate))+Principal

TDS=Total debt service

How you can calculate debt Service coverage ratio in excel?

To create a dynamic Debt-service coverage ratio formula in Excel, you cannot simply run an equation that will divide net operating income from the debt service.

Rather, you would be having a title of two successive cells, such as A2 and A3, “net operating income,” and “debt service.” Then, next to those cells, in B2 and B3, you would be placing the respective figures from the income statement.

Enter a formula in a separate cell for Debt-service coverage ratio using the B2 and B3 cells rather than having actual numeric values (e.g., B2 / B3).

Even for a simple calculation, it will be best to use a dynamic formula that can be particularly adjusted and can be calculated again automatically. One of the primary reasons for calculating the Debt-service coverage ratio is to compare it with various other firms in the industry. This kind of comparison can be easier to run if you can plug in the numbers.

Interpretation of the Debt Service Coverage Ratio.

A company with a debt service coverage ratio of 1 or above indicates that it generates sufficient operating income for covering its annual debt and interest payments.

As a general rule, an ideal ratio is two or higher. This ratio indicates that high is suggested that the company is capable enough of taking on more debt. A ratio that is less than 1 is not much optimal because it usually reflects its inability to servicing its current debt obligations with operating income alone.

E.g., a Debt-service coverage ratio indicates 0.8 that there is only enough operating income for covering 80% of the company’s various debt payments. Rather than just having a number that is isolated, it is mostly better to have a company’s debt service coverage ratio, which can be relative to the ratio of other companies in the same sector.

Suppose a company has a significantly higher Debt-service coverage ratio than most of its competitors, which usually indicates superior debt management. An analyst from the financial sector may also want to look at a company’s ratio over time to see whether the trend is improving or going downward means it’s getting the contribution margin worse.

What does Debt Service coverage ratio tell you?

Routinely, a lender may assess a borrower’s Debt-service coverage ratio before making a loan.

A Debt-service coverage ratio that is less than one means that the cash flow is negative, which also means that the borrower will not be able to cover or pay current debt obligations without drawing on or using other outside sources.

E.g., a Debt-service coverage ratio of 0.95 means that there is only sufficient net operating income to cover 95% of the annual debt payments. According to personal finance, this would also mean that the borrower would have to delve into their funds every month to keep their project floating.

In general, the lenders who frown on negative cash flow might allow some borrowers to have strong resources under their income. If the coverage ratio is too close to 1, e.g., 1.1, the entity is vulnerable, and also, there is a minor decline in cash flow that could render it unable to service its debts.

In some cases, Lenders might require that the borrower maintain a certain minimum Debt-service coverage ratio while the loan is also outstanding. Some agreements will also be considered as a borrower who might fall below that minimum to be in default.

Typically, a Debt-service coverage ratio greater than 1 means that the entity, whether an individual, company or government, might have sufficient income for paying its various current debt obligations. The minimum Debt-service coverage ratio is a lender that will be demanding that can be dependent on macroeconomic conditions.

If the economy is growing, then the credit will be more readily available, and the lenders might be more forgiving of various lower ratios. A tendency to lend for less-qualified borrowers can, in turn, affect economic stability, as the case was rising to the 2008 financial crisis.

Some subprime borrowers will be able to obtain credit, particularly mortgages, and with little scrutiny. While these borrowers can begin to default en masse, the financial institutions have collapsing finance.

What is a Good Debt Service coverage ratio?

Suppose the calculation of the Debt-service coverage ratio results in a figure of “1” or above. In case, it can even mean that the revenue generated from the business or property will be enough to cover its debts.

It does not mean someone with a perfect score of “1” will get a loan. It is unlikely that “1” means a business with exact enough cash flow that can pay off its expenses, but that is all. In this, it leaves no room for any or various unexpected additional costs.

The number that is higher above “1” is more likely banks who approve loans and better payment terms and lower interest rates that can repay.

Like a United States government agency designed for helping small businesses, the Small Business Association requires a minimum Debt-service coverage ratio of 1.15 allows to grant loans over $350,000. Companies with a score less than a “1” may still be able to get their loans granted by establishing a debt service reserve account.

This account also protects the lenders by having funds that are set aside to support their loan. Typically, six months after a year’s worth of debt service payments can be placed in a debt service reserve account.

Keep in mind that the Debt-service coverage ratio calculates the good for both the lender and the business applying for the loan.

It can be because of the business which can do the calculations to determine first if the asking is too much.

From the result, it can also help to increase their Debt-service coverage ratio before applying, and by doing so, it can get a better position to get approval on various loans.

Interest coverage ratio vs. Debt Service coverage ratio-

The interest coverage ratio helps in indicating the number of times in which a company’s operating profit would be covering the interest it must pay on all of its debts for a given period. It is also expressed as a ratio and is most often computed on an annual basis.

For calculating the interest coverage ratio, we have to divide the earnings before income and tax to establish the period by the total interest payments due for that same period. The earnings before income and tax, often called net operating income or even operating profit, can be calculated by deducting the overhead and operating expenses like rent, cost of various goods, freight, wages, and various utilities from revenue.

This number also reflects the amount of cash available after deducting all the expenses necessary to keep the business running. The higher the ratio of earnings before tax and income to interest payments, the more financially stable the company.

This metric only considers its interest payments and not payments made on principal debt balances that the lenders may require. The debt-service coverage ratio can be slightly more comprehensive if a company’s abilities assess this metric for meeting its minimum principal and interest payments, including sinking fund payments, for a particular period.

For calculating the Debt service coverage ratio, earnings before income and taxes have been divided with the total principal and interest amounts payments required for a given period for obtaining net operating income. Because it is considered as principal payments in addition to interest, the Debt-service coverage ratio is a slightly more robust indication for the company’s financial fitness.

In other cases, it might be possible that a company with a debt-service coverage ratio which is less than 1.00 does not generate enough revenue for covering its expenses of minimum debt. It represents a risky prospect in business management or investment since even a brief period of lower-than-average income could spell disaster.

Total debt service ratio vs. Gross debt service ratio-

As the tax debt service ratio is very similar to the gross debt service ratio, an applicant’s gross debt service ratio does not account for non-housing related payments like credit card debts or car loans. The gross debt service ratio can also be referred to as the housing expense ratio. Generally, borrowers can be striving for a gross debt service ratio of 28% or even less.

Generally, you might also hear that gross debt service and total debt service can refer to Housing 1 and Housing 2 ratios. In account, the key components like the gross debt service ratio, total debt service ratio, and a borrower’s credit score are analyzed in the underwriting process for a particular mortgage loan.

Gross debt service can be used in other personal loan calculations, but it is also most commonly used in mortgage lending.

Some special considerations-

There is a limitation of the interest coverage ratio that is not explicitly considered the firm’s ability to repay its debts.

Most of the long-term debt can be issued, which contains provisions for amortization with dollar sums which are involved in comparing with the requirement of the interest, and failure to meet the requirement of the sinking fund, which is also an act of default that can even force the firm for getting bankruptcy.

The measure of a ratio for repaying ability of a firm is the fixed charge coverage ratio.

Frequently Asked Questions:

How to calculate debt service coverage ratio?

For calculating the debt service coverage ratio, divide the net operating income (NOI) by the annual debt. This example tells us that the property’s cash flow will cover the new commercial loan payment by 1.10x. It is generally lower than most commercial mortgage lenders require.

What is debt service coverage ratio?

The ratio of debt service coverage is also known as the “debt coverage ratio,” which is the ratio of the available operating income for debt servicing for interest, principal, and various lease payments. It is also a very popular benchmark used to measure a person’s or corporation’s potential for producing enough cash to cover its debt payments, including the lease payments.

When we work out the higher this ratio is, the easier it is to obtain a loan. This phrase is also used in commercial banking and may be expressed as a minimum ratio acceptable to a lender; it may be a loan condition.

Breaching a Debt-service coverage ratio covenant can, in some circumstances, be an act of default.

What is a good debt service coverage ratio?

The ratio of 1 or above from a debt service coverage ratio can indicate that a company is generating sufficient operating income for covering its annual debt and various interest payments.

As a general rule, an ideal ratio is two or even higher. A high ratio mainly suggests that this company is capable of taking on more debt.

Why is the Debt Service coverage ratio important?

Debt-service coverage ratios are a very commonly used metric while negotiating for the loan, which contracts between multiple companies and various banks. For instance, if a business is applying for a credit line, it might be obligated to ensure that its debt-service coverage ratio does not fall below 1.25.

If it does, then the borrower can be found to have defaulted on the loan by giving the bank the authority to call the debt or take various other corrective measures.

In addition also to help the banks to manage their risks, Debt-service coverage ratios can also be helpful for the analysts and investors to analyze the company’s financial strength.

Know more about Asset Turnover Ratio

My Name is Nadeem Shaikh the founder of nadeemacademy.com. I am a Qualified Chartered Accountant, B. com and M.Com. having professional and specialize experience in field of Account, Finance, and Taxation. Total experience of 20 years in providing businesses solution in Taxation, Accounting, and Finance with all statutory compliance with timely business performance Financials reports. You can contact me on nadeemacademy2@gmail.com or contact@nadeemacademy.com.