Looking for answer for How to file an income tax return ?

The process to file Income Tax Returns by using the internet is called E-filing. The process to e-file Income Tax Returns is quick, easy, and can be completed from the comfort of an individual’s home or office.

E-filing income tax returns can also help save money as you would not have to hire a person for filing an income tax return.

Note: File your taxes through the new portal income tax. The New portal is included with a plethora of features and is designed in such a way to ease the tax filing process.

Proper guide on How to Login or Register on the portal of e-filing:

STEP 1: Visit the following website https://www.incometax.gov.in/iec/foportal for e-filing.

STEP 2: Then register or Login yourself to e-file your returns.

- Earlier, If you have registered yourself on the portal, you can click on the ‘Login here’ button by which you can directly access your account.

- If you have not registered yourself on the portal, click on the ‘Register yourself’ button.

STEP 3: Click or select on the ‘Taxpayer’ option and then fill up the details of your PAN and click on ‘validate.’ After validation is completed, then next click on ‘Continue.’

STEP 4: Provide details on the website for further process such as your name, address, gender, residential status, date of birth, etc.

STEP 5: Submit your Email ID and registered mobile number.

STEP 6: Once all the basic details have been filled up in the following form, then click on ‘Continue’ to proceed further.

STEP 7: Then, you will have to verify all the details entered in the following, by which One Time Password (OTP) of 6 digits will be sent to your registered mobile number and even to your Email address.

STEP 8: By following the given instructions, enter the received OTP on your registered mobile number or email address for completing the registration process.

STEP 9: Once the verification of the OTP is completed, a new window will open where you can see all the information provided by you then you will have to verify all the details.

If any given detail is incorrect, you can also change it, following which another OTP will be sent for validating all the changes made.

STEP 10: Final step is to set up a password and securing the login credentials.

STEP 11: Click on the ‘Register’ button, following which you will be receiving an acknowledgement message which states that the registration process has been completed.

Proper guide on how to e-file Income Tax Returns on the portal-

As per the rules of the income tax laws, calculate your income tax liability.

Use your Form 26AS to summarize your TDS payment for all four quarters of the assessment year.

Based on the definition provided by the Income Tax Department for each Income Tax Return form, determine the category that you have fallen under and also choose an Income Tax Return form accordingly.

The steps mentioned below are for e-file your income tax returns using the Income-tax e filing portal:

STEP 1: Go to the portal of Income Tax (Official one) for e-filing and then Click on the ‘Login’ button.

STEP 2: Next, insert Username and then Click ‘Continue’ and after that enter your Password.

STEP 3: Once you are done logged in successfully, click on the mentioned tab tagged as ‘e-file and then click on the ‘File Income Tax Return’ option.

STEP 4: Select the year (Assessment Year) for which you want to file your income tax returns, and then click on the ‘Continue’ option.

STEP 5: You have to choose whether you want to file your returns online or offline.

In this case, you have to choose the former, which is also considered the recommended tax filing mode.

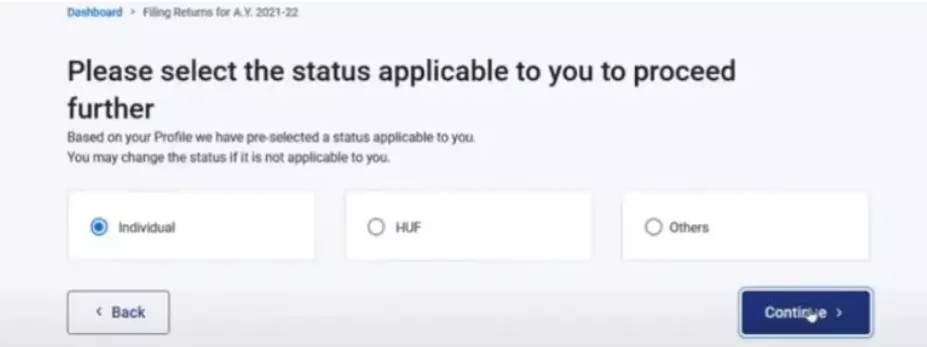

STEP 6: Then you have to choose whether you wish to file your income tax returns as an individual, Hindu Undivided Family, or others.

Choose the option ‘Individual.’

STEP 7: Choose the income tax returns which you wish to file.

E.g., Income Tax Return 2 can be filed by those individuals and Hindu Undivided Families who are not having any income from any business or profession.

Similarly, in the case of an individual, they can choose the option Income Tax Return 1 or Income Tax Return 4. Here you have to click on ‘Proceed with Income Tax Return 1’.

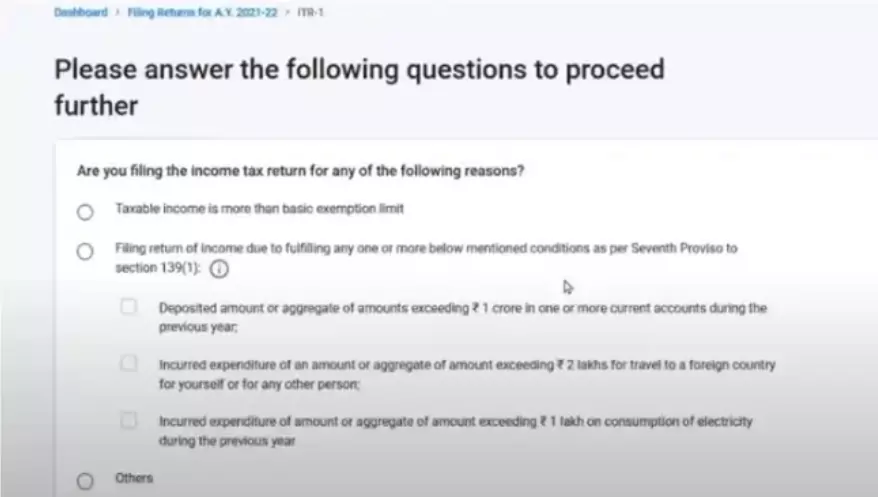

STEP 8: Then, in the next step, you will be asked for the reason behind filing your returns as according to the above mentioned basic exempted limit or even because of the seventh provision under Section 139(1).

According to the following section, if the aggregate amount which an individual deposits are exceeding the limit of 1 Crore INR in one or more current accounts during the year and exceeds 2 lakh INR on a foreign trip, or if a payment is made of more than 1 lakh INR on electricity bills, then the person is eligible for filing their income tax returns. But always make sure that you are correctly choosing the right option to proceed further.

STEP 9: Complete the procedure of filling in the details of your bank account. If you have already provided your bank account details, then you can pre-validate it.

STEP 10: You will then be navigated to a new page to file your income tax returns. This page will contain a lot of information that is filled in already.

Check them and make sure that all the details mentioned are correct. Then confirm the summary of your returns and proceed to validate it.

STEP 11: This is your final step to verify your returns and send a hard copy of them to the Income Tax Department. This verification process is compulsory.

A guide on how to file Income Tax Returns offline for Super Senior Citizens:

Super senior citizens are those individuals who are 80 years old and above. They are provided with the option for filing their Income Tax Return offline during the financial year.

Another instance where the Income Tax Return can be filed offline is if an individual or Hindu Undivided Family has an income of less than 5 lakh INR and is not entitled to receive a refund.

Proper procedure and step by step method for filing returns offline is mentioned below:

- An individual must request a Form 16.

- Next, you will be needed to submit the Income Tax Return in paper format at the Income Tax Department.

- Once the form’s submission is made, you will be receiving an acknowledgement slip from the Income Tax Department as evidence.

Refer below if you want to Know How much is Senior Accountant Salary

My Name is Nadeem Shaikh the founder of nadeemacademy.com. I am a Qualified Chartered Accountant, B. com and M.Com. having professional and specialize experience in field of Account, Finance, and Taxation. Total experience of 20 years in providing businesses solution in Taxation, Accounting, and Finance with all statutory compliance with timely business performance Financials reports. You can contact me on nadeemacademy2@gmail.com or contact@nadeemacademy.com.