Objective and Complete details Ind AS 40 Investment Property

The objective of IND AS 40 standard is for prescribing the accounting treatment for property (land or buildings) which is held to as to earn rentals or for capital appreciation (or both) and related disclosure requirements. Ind AS 40 prescribes the cost model for accounting for investment property.

SCOPE of Ind AS 40: Investment Property

1) Ind AS 40 should be applied in the recognition, measurement and disclosure of investment property.

2) This Standard doesn’t apply to:

a) Biological assets are also related to agricultural activity (see Ind AS 41 ‘Agriculture’ and Ind AS 16 ‘Property, Plant and Equipment).

b) Mineral rights and mineral reserves and minerals such as oil, natural gas and similar non-regenerative resources.

RELEVANT DEFINITIONS

The following are the key Investment Property-related definitions:

1) Investment property is the property (land or a building—or part of a building—or both) which are held by the owner or by the lessee as a right-of-use asset for earning rents or for capital appreciation or even both, rather than for:

a) Use in the supply or production of goods or services or for various administrative purposes or

b) Sale in the course of ordinary course of business.

The property mentioned in (a) above would be covered under Ind AS 16 ‘Property, Plant and Equipment and property specified in (b) above would be dealt with under Ind AS 2 ‘Inventories.’

2) Owner-occupied property is the property which is in hold by any owner or by lessee as the right-of-use asset for use in the production or supply of goods or services or administrative purposes.

Ind AS 16 ‘Property, Plant and Equipment applies to owner-occupied property, and Ind AS 116 ‘Leases’ applies to a owner-occupied property which is held by a lessee as a right-of-use asset.

3) Fair value is the value that would be received to sell any asset. When it is paid to transfer a liability in an orderly transaction between market participants at the measurement date. (See Ind AS 113 ‘Fair Value Measurement’).

4) Cost is the mainly the amount of cash or cash equivalents paid. Also the fair value of other any consideration which is given to acquire any asset at the time. Acquisition or a construction or, where applicable. Mainly the amount which is attributed to that asset when initially recognized following the specific requirements of other Ind ASs, e.g., Ind AS 102, Share-Based Payment.

5) Carrying amount is the value at which an asset is recognized in the balance sheet.

CLASSIFICATION OF PROPERTY AS OWNER-OCCUPIED PROPERTY OR INVESTMENT PROPERTY

Nature of Investment property

Investment property which is in hold for earning rentals or for capital appreciation, or both. Therefore, an investment property can largely generates cash flows which is independent of the other assets held by an entity. It distinguishes investment property from the owner-occupied property.

Accordingly, investment properties could represent a cash-generating unit since they generate cash inflows that are mainly largely an independent of any cash inflows from other assets or groups of assets, thus meeting the definition of cash-generating unit laid down in Ind AS 36, ‘Impairment of Assets.

The production or supply of services or goods or the use of the property for administrative purposes generates cash flows attributable to property and other assets used in the production or supply process.

Ind AS 16 ‘Property, Plant and Equipment applies to owner-occupied property, and Ind AS 116 applies to the owner-occupied property held by a lessee as a right-of-use asset.

Refer material as per IND AS 40 MCA

Examples of Ind AS 40 investment property

The following are some examples of investment property:

a) Land which is held for long-term capital appreciation rather than short-term sale in the ordinary time of business.

b) Land which is held for a currently undetermined future use. (If an entity have not determined that it would be using the land as owner-occupied property or for short-term sale in the ordinary time of business, the land is regarded and can be held for capital appreciation.)

c) A building which is owned by an entity (or a right-of-use asset relating to any building held by the entity. Leased out an under one or more operating leases.

d) A vacant building that is held and can be leased out under one or multiple operating leases.

e) Property that have being constructed or developed for future use as an investment property.

3) Examples of items that are not an investment property

The following are some examples of items that are not investment property and are therefore can be outside the scope of this Standard:

a) Property which is intended for sale in the ordinary course of business or the construction or development process for such sale (see Ind AS 2, Inventories), for example, property acquired exclusively with a view to subsequent disposal shortly or for development and resale.

b) Owner-occupied property (see Ind AS 16 and Ind AS 116), including, (among other things):

(i) Property which is held for future use as owner-occupied property.

(ii) Property which is held for future development and subsequent use as owner-occupied property.

(iii) Property occupied by employees (whether or not the employees pay rent at market rates) and

(iv) Owner-occupied property awaiting disposal.

c) Property leased to any another entity under a finance lease.

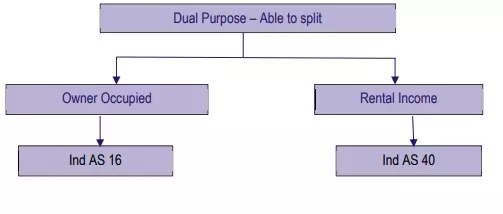

4) Property held for more than one purpose

In circumstances when the property is held partly for capital appreciation or rentals and partly for production or a supply of goods or services or administrative purposes. The two parts are accounted for separately if they could be sold, or leased out separately under a finance lease, separately.

If they couldn’t sold (or leased out under a finance lease) separately, the property is accounted for as an investment property. If an insignificant portion is mainly held for use in the production or supply of goods or services or for administrative

5) Ancillary services

In some of the cases, an entity should be providing ancillary services to the occupants of a property that it holds. An entity also treats such a property as investment property if the services are unimportant to the arrangement. In case, is when the owner of an office building is providing security and maintenance services to the lessees who is occupying the building.

In several other cases, the services which are provided can be significant. For example, if an entity is owning and managing a hotel, services provided to guests are significant to the arrangement as a whole. Therefore, an owner-managed hotel is an owner-occupied property rather than an investment property.

6) Difficulty in deciding classification under investment property

It might be difficult for determine whether ancillary services are so significant that they do not qualify as an investment property. For e.g., a hotel owner sometimes also transfers some responsibilities to third parties under the contract of management.

The terms of such contracts can vary widely. At one end of the range, the owner’s position may be in substance and be that of a passive investor. At another end of the spectrum, the owner may have outsourced day-to-day type of functions. While retaining a significant exposure to variation in the cash flows generated by the hotel’s operations.

Judgment is needed for determining whether a property qualifies as an investment property. An entity develops criteria to exercise that judgment consistently following the definition of investment property and with the related guidance discussed above.

The standard requires an entity to disclose these criteria. It distinguishes investment property from owner-occupied property and from property held from sale in the ordinary course of business when classification is difficult.

Judgment is also required to determine whether there is a acquisition of Investment Property. The acquisition of any asset or a group of an assets or a business combination within the meaning of scope of Ind AS 103. It is Business Combinations which is a reference should be made to a Ind AS 103 to mainly to determine whether it is a business combination.

The discussion in the above points relates to whether or not a property is owner-occupied property or investment property and not to determine whether or not the acquisition of property is a combination of

business that defined in Ind AS 103. Determining whether a specific transaction is meeting the definition of a business combination defined in Ind AS 103 and which will includes an investment property as defined in this Standard requires the separate application of both Standards.

7) Property leased to other group members – treatment of same asset differently in the individual financial statements and the consolidated financial statements

In some cases, an entity also owns property that are leased and have been occupied by its parent or some another subsidiary. The property doesn’t qualify as investment property in the combined financial statements because the property is owner-occupied from the group’s perspective.

However, from the viewpoint of the entity that owns it, the property is investment property if it meets the definition of Investment Property. Therefore, the lessor also treats the property as investment property in its financial statements.

RECOGNITION in Ind AS 40

General principle

An owned investment is property shall be recognized as an asset when, and only when:

a) Probably, the future economic benefits associated with the investment property will flow to the entity.

b) The expense of the investment property can be reliably measured.

This general principle is used to consider whether capitalization is appropriate both in respect of the cost incurred in a initially to acquire or construct an owned investment property. The costs incurred subsequently will be add to, replace part of, or service a property.

An investment property which is hold by a lessee as a right-of-use asset shall be recognized following Ind AS 116.

Subsequent costs

Day-to-day servicing costs-

Under the recognition principle set out above, an entity does not recognize the costs of the day-to-day servicing of such property in the carrying amount of an investment property.

Rather, these costs are recognized in the profit or loss as incurred. Costs of daily servicing are primarily the cost of labor and consumables and might be including the cost of minor parts. The purpose of these expenditures can be often described as for the ‘repairs and maintenance of the property.

Replacement costs-

Parts of investment properties might have been acquired through replacement. Under the recognition principle, an entity recognizes costs incurred to mainly replace parts of original property in the carrying amount in investment property. if they meet the recognition criteria. The carrying value of those parts that are replaced is derecognized following the derecognition provisions of this Standard.

MEASUREMENT OF RECOGNITION

Measurement at recognition – general

An owned type investment property should be bascially measured initially at its cost. Transaction costs are mainy included in the initial measurement.

Cost Inclusions-

The cost of a purchased investment property also comprises its purchase price and any of directly attributable expenditure. The professional fees for legal services, property transfer taxes and other transaction costs.

Cost Exclusions-

The cost of an investment property isn’t increased by:

a) Start-up costs cannot be necessary for bringing the property for the condition which is necessary.It is capable of been operating in the manner which the intended by management.

b) Operating losses which are incurred before the investment property is achieving the planned level of occupancy.

c) Abnormal value of wasted material, labor or other resources can be incurred in constructing or developing the property.

2) Deferred payments

If payment for an investment property is delay then its cost will be cash price equivalent. The distinction between this amount and the total payments can be recognized as interest expense throughout the credit.

Investment property acquired through exchange of another asset.

One or more investment properties might be acquired by exchange for a non-monetary asset. Assets or any combination of monetary and or non-monetary assets. The cost of such an investment property can be measured at fair value unless:

a) The exchange transaction lacks commercial substance.

b) The fair value of nor the asset which is received nor the asset is given up is reliably measurable.

The acquired asset can be measured in this way, even if an entity cannot be immediately derecognizing the asset which is given up. If the acquired asset cannot be measured at fair value, its cost is measured at the carrying amount of the asset given up.

An entity can determine whether AS an exchange transaction has commercial substance by mainly considering the extent to which company future cash flows are expected to change due to the transaction. An exchange transaction can be commercial substance if:

a) The arrangement (risk, amount and timing ) of the cash flows of the asset is received differs from the mainly in configuration of the cash flows of the asset transferred.

b) The entity mainly which is specific amount of the portion of the entity’s operations can be affected by the transaction changes resulting from the exchange.

c) The difference between (a) or (b) is significant which is relative to measuring a fair value of any assets exchanged.

To mainly determine whether you seen an exchange transaction has commercial substance. The which has entity-specific value of the portion of the entity’s operations affected by the transaction, as mentioned earlier, shall reflect the post-tax cash flows. The result of this analysis may be clear without an entity having to perform detailed calculations.

The fair value of any asset which can be reliably measurable if:

a) The fluctuation in the range of reasonable, fair value measurements cannot be significant for that asset.

b) The probabilities of the various can be estimated within the range can be reasonably assessed and used when measuring fair value.

Suppose the entity can measure reliably the fair value of either the asset received or the asset is given up. In case, the fair value of any asset which is given up mainly to used or to measure cost unless the fair value. The asset received is more clearly evident.

An investment property can be held by a lessee as a right-of-use asset should be measured initially at its cost following Ind AS 116.

MEASUREMENT AFTER RECOGNITION

Accounting Policy

An entity that shall adopt as its an accounting policy the cost model to all of its investment property.

Cost Model-

After initial recognition, an entity shall measure investment property:

(a) Following Ind AS 105, Non-current Assets which is Held for Sale and Discontinued Operations if it mainly meets any of the criteria. To be classified as a held for sale. It is included in a disposal group that is classified as held for sale.

(b) Following Ind AS 116 if it is held by a lessee as a right-of-use asset and is not held for sale following Ind AS 105.

(c) Following the requirements in Ind AS 16 for cost model in all other cases.

Entities are required to measure the fair value of investment property for disclosure even though they must follow the cost model. An entity can be encouraged but is not required for measuring the fair value of an investment property.

Based on a valuation by any independent valuer mainly who holds a recognized and a relevant professional qualification. Recent experience in location and a category of the investment property being valued.

Summary

While measuring the fair value in Ind AS 40 Investment Property following Ind AS 113, an entity should ensure that any fair value reflects. Among other things, rental income from a current leases and or any other assumptions that are market participants would you are using pricing investment property under current market conditions.

When a lessee measures the fair value of an investment property held as a right-of-use asset. It shall also measure the right-of-use asset and not the underlying property at fair value.

Inability for measuring the fair value reliably.

There is a disproving presumption that an entity can reliably measure the fair value of an investment property continuingly.

Situations when fair value is not reliably measurable:

In unusual cases, there is a clear evidence when any entity first who acquires an investment in property (or when an existing property first becomes investment property after a use change) that the fair value of any property will not be reliably been measurable continuingly.

The usefulness of a single point measurement of fair value, which is required, gets negated in the above exceptional cases due to – (a) great variability in the range of reasonable, fair value measurements, and (b) serious difficulty in the assessment of the probabilities of the various outcomes.

It arises when, and only when-

(a) The market for comparable properties is inactive (e.g., few recent transactions, a price quotations are any current or observed transaction prices indicate that the seller was forced to sell).

(b) Alternative reliable, fair value measurements (for example, based on discounted cash flow projections) are not available.

My Name is Nadeem Shaikh the founder of nadeemacademy.com. I am a Qualified Chartered Accountant, B. com and M.Com. having professional and specialize experience in field of Account, Finance, and Taxation. Total experience of 20 years in providing businesses solution in Taxation, Accounting, and Finance with all statutory compliance with timely business performance Financials reports. You can contact me on nadeemacademy2@gmail.com or contact@nadeemacademy.com.