Predetermined overhead rate definition

An overhead rate, or predetermined overhead rate, is an allocation rate used to calculate the cost of manufacturing overhead and cost objects for a particular reporting period. This rate is often used to speed up the closing of books, as it does not require the compilation of actual manufacturing overhead cost during the closing period.

The difference between actual and estimated overhead costs must be reconciled at the least at the end each fiscal year.

A predetermined overhead rate is used for manufacturing overhead. It is calculated at the beginning each period by subtracting the estimated manufacturing overhead cost from an allocation base (also called activity base or activity driver). The most common allocation bases are direct labor hours and direct labor dollars.

Larger companies may use a different overhead rate for each production department. This tends to increase overhead accuracy by using a higher level precision. The amount of accounting labor required to use multiple overhead rates can increase, however.

How to Calculate an Overhead Rate Predetermined ?

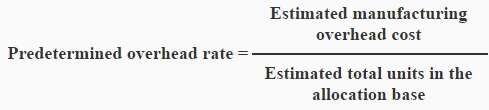

This calculation calculates the predetermined rate:

Estimated manufacturing overhead to be incurred during the period/Estimated allocation base for this period

There are many possible allocation bases for the denominator. These include direct labor hours, direct labour dollars and machine hours.

Example of a predetermined overhead rate

One Radio Company’s controller wants to establish a predetermined overhead rate. This will allow her to apply overhead faster in each reporting period and facilitate closing the process. She uses the average manufacturing overhead cost over the last three months to calculate this figure.

Then she divides that number by the estimated machine hours to be used in each month, based upon the most recent production schedule. The result is that $50,000 was allocated to inventory for the period. An analysis later revealed that $48,000 was actually the correct amount to be allocated to inventory. Therefore, the $2,000 difference in the price of goods sold is charged.

Problems with predetermined overhead rates

There are many concerns about using a predetermined overhead fee. These are discussed below.

The Overhead Rate Is Not Realistic

It is possible that the overhead rate may not be as close to what the calculations produce because both the denominator and numerator are estimates.

Faulty Sales and Production Decisions

If the overhead rate is incorrect and sales or production decisions are made partly on it, the rates will also be affected.

Variance Recognition Issues

The difference in overhead between actual and predetermined amounts could be charged to expense for the current period. This may cause a material change in profit or inventory asset reported.

A weak link to historical costs

If there is an abrupt rise or fall in manufacturing overhead, historical information may not be applicable.

Predetermined overhead rate

Companies can use predetermined overhead rates in a variety of ways, including:

Closing the books: This rate is used by businesses to close their books faster because it doesn’t require them to calculate overhead costs. They will have to reconcile the difference in actual overhead and estimated amounts at the end their fiscal year.

Monitoring relative expenses: Companies can monitor a predetermined overhead rate on a quarterly basis. They can also monitor the base and expense separately on a monthly, weekly, and even a monthly basis. This will help to ensure that costs don’t rise over time.

Monitoring overhead rate: To monitor expenses throughout the year, a company can periodically calculate its actual costs and compare it to a predetermined overhead rate.

Pricing: A company can set a price that is fair and allows it to make a profit if it understands its overhead costs per product/labor hour.

My Name is Nadeem Shaikh the founder of nadeemacademy.com. I am a Qualified Chartered Accountant, B. com and M.Com. having professional and specialize experience in field of Account, Finance, and Taxation. Total experience of 20 years in providing businesses solution in Taxation, Accounting, and Finance with all statutory compliance with timely business performance Financials reports. You can contact me on nadeemacademy2@gmail.com or contact@nadeemacademy.com.