CORE PRINCIPLE Ind AS 23 Borrowing Costs Accounting Standards

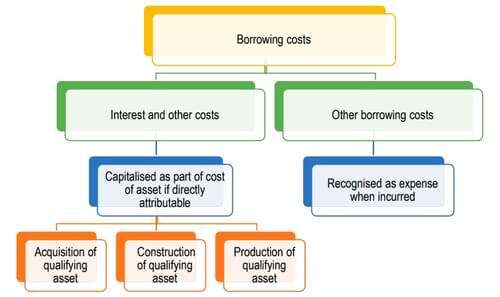

The core principle of Ind AS 23 states that:

- Borrowing costs that are directly attributable to the acquisition, construction or production of a qualifying asset are included in the cost of that asset, i.e., must be capitalized.

- Other borrowing costs are mainly recognized as one type of an expense in the period that are which they are incurred.

SCOPE OF THE STANDARD

An entity should be applying for this standard in accounting for borrowing costs.

The Standard does not basically apply to mainly a actual or a imputed cost of a equity, by including preferred capital which is not classified as a liability.

The general requirement of this standard (to capitalize directly attributable borrowings cost) is not required to be applied to:

(a) Qualifying assets measured at fair value, for example, a biological asset accounted for under Ind AS 41. If the assets are held under the fair value model with all changes going to the statement of profit or loss.

Then capitalization would not affect the measurement in the statement of financial position and would involve the only reallocation between finance cost and fair value movement in the Statement of profit and loss.

(b) Inventories that can be mainly manufactured, or a otherwise produced, in a large quantities on a repetitive type of basis even if they are taken as a substantial period to mainly get a ready for a sale.

This exemption acknowledges the difficulty both in allocating borrowing costs to such inventories and monitoring those borrowing costs until the inventories are sold.

KEY DEFINITIONS Ind AS 23 Borrowing Costs Accounting Standards.

Following are the terms defined in the standard:

- Borrowing costs: These are interest and other costs that an entity incurs in connection with the borrowing of funds. Borrowing costs may include:

Interest expense that can be calculated by using mainly the effective interest rate method as described in a Accounting Standards Ind AS 109 Financial Instruments.

Interest in respect of lease liabilities recognized following Ind AS 116, Leases.

Exchange differences that are arise from a foreign currency as a borrowings to the main extent that they are an looking for an adjustment to interest costs.

- Qualifying asset: The qualifying asset is an asset that necessarily takes a substantial time to get ready for its intended use or sale. Examples of qualifying assets are manufacturing plants, real estate and infrastructure assets such as bridges, railways, etc.

Ind AS 23 doesn’t provide any guidance on what constitutes a ‘substantial period of time.’ The specific circumstances and facts should be considered in each case. For example, a period of twelve months or more might likely be considered ‘substantial.’

Depending on various circumstances, any of the following may be qualifying assets:

(a) Inventories.

(b) Manufacturing plants.

(c) Power generation facilities.

(d) Intangible assets.

(e) Investment properties.

(f) Bearer plants.

Financial assets and inventories manufactured, or otherwise produced over a short time, are not qualifying assets.

Assets that are been prepared for their type of intended use or a sale when it can acquired are not qualifying assets.

EXCHANGE DIFFERENCE TO BE INCLUDED IN BORROWING COSTS

The extent to which exchange differences can be considered borrowing cost depends on the terms and conditions of the foreign currency borrowing.

The gains and a losses that are can be adjusted to a interest costs include mainly a the interest rate which are differential between the borrowing costs that are incurred if the entity borrowed that are funds.

Its functional currency and a borrowing costs incurred on a foreign currency borrowings. An entity may borrow funds in a currency that is not its functional currency, e.g., A Company with INR functional currency may take a US dollar loan for financing an asset development project in a company.

It may have been done on the basis that, throughout the development of the asset, the borrowing costs, even after allowing for exchange differences, were expected to be less than the interest cost of an equivalent INR loan.

The following approach is to be followed for determining the extent to which the exchange difference should be treated as borrowing costs you can refer IND AS 23 Borrowing cost in ICAI Portal :

(i) The adjustment should be of a value which is equivalent to the extent to which the exchange loss does not exceed the difference between borrowing in functional currency costs which are compared to the value of borrowing in a foreign currency.

(ii) If there is an unrealized exchange loss which can be treated as an adjustment to interest and subsequently there is an unrealized or realized gain in respect of the settlement or translation of the same borrowing, the gain to the extent of the previously recognized loss as an adjustment can also be recognized as an adjustment to interest.

RECOGNITION Ind AS 23 Borrowing Costs

Borrowing costs which can be directly been attributable to a acquisition, a construction or a production of a qualifying asset and are capitalized as part of the cost of the qualifying asset.

Such borrowing costs are capitalized when the below two conditions are satisfied:

– It is probable that it will result in future economic benefits to the entity.

– The costs can be measured reliably.

Other borrowing costs which can be recognized as an type of an expense in period in which they are been incurred.

When an entity applies Ind AS 29 Financial Reporting in Hyperinflationary Economies, it recognizes as an expense the part of borrowing costs that compensates for inflation during the same period.

Borrowing costs eligible for capitalization:

The borrowing costs that are permitted for capitalization are those borrowing costs that would have been avoided if the expenditure on the qualifying asset had not been made.

Since it may not always be easy to identify a direct relationship between individual borrowings and a qualifying asset and determine the borrowings that could otherwise have been avoided, the standard includes separate requirements for specific borrowings and general borrowings.

Specific borrowing costs-

If an entity borrows funds specifically to obtain a qualifying asset, the borrowing costs directly related to that qualifying asset can be readily identified.

The borrowings cost eligible for capitalization would be the actual borrowing costs incurred during the period less any investment income on the temporary investment of those borrowings.

An entity may obtain borrowed funds and incur associated borrowing costs before some or all of the funds are used for expenditures on the qualifying asset. In such a circumstances, the funds are often mainly temporarily been invested in pending on their expenditure on the qualifying asset.

In determining the number of borrowing costs eligible for capitalization during a period, any investment income earned on such funds is deducted from the borrowing costs incurred.

General borrowing costs-

All borrowings that are not specific represents general borrowings.

When funds are borrowed specifically for a qualifying asset, costs concerning that borrowing are accounted for as specific borrowing costs until the asset is ready for its intended use or sale; if the borrowing remains outstanding after the related asset is ready for its intended use or sale, it becomes part of ‘general borrowings.’

Calculation of capitalization rate:

When the funds are borrowed generally to obtain a qualifying asset, the entity shall determine the number of borrowing costs eligible for capitalization by applying a capitalization rate to the expenditures on that qualifying asset.

The rate of capitalization is the weighted average of the borrowing costs applicable to all the general borrowings of the entity that are outstanding during the period.

Borrowing costs regarding specific funds borrowed to obtain a qualifying asset shall be excluded from the calculation of capitalization rate until substantially all the activities necessary to prepare that qualifying asset for its intended use or sale are complete.

The number of borrowing costs that an entity capitalizes during a period shall not exceed the number of borrowing costs incurred during that period.

Expenditure to which capitalization rate is applied:

In determining the borrowing costs to be capitalized, the amount of expenditure on a qualifying asset includes only those expenditures that have resulted in cash payments, transfers of other assets or the assumption of interest-bearing liabilities.

Expenditures can be reduced mainly by any type of progress payments that are received and grants received from any asset (for further a understanding it can be seen in Ind AS 20 Accounting for Government Grants and a government assistance disclosure).

The average carrying value of the asset during a period, including borrowing costs previously capitalized, is normally a reasonable approximation of the expenditures to which the capitalization rate is applied in that period.

Excess of the carrying amount over recoverable amount:

While that carrying amount or which is expected ultimate a cost of the a qualifying any asset exceeds it’s a recoverable that the amount or a net realizable value. The carrying amount is mainly written down or a written off following other type of standards’ requirements. In certain cases, the amount of the write-down or write-off is written back following those other Standards.

PERIOD OF CAPITALISATION Ind AS 23 Borrowing Costs

Commencement of capitalization:

An entity is required to begin capitalizing borrowing costs as part of the cost of a qualifying asset on the commencement date.

The commencement date is basically the date when any entity is first meets all of the a following conditions a cumulatively on a particular type of date-

(a) It incurs expenditures for the asset.

(b) It incurs borrowing costs.

(c) It undertakes necessary activities to prepare the asset for its intended use or sale.

Suspension of capitalization:

Capitalization of a borrowing costs that shall be mainly suspended during extended type of periods in which that a type of active development. Also a qualifying asset is suspended. Such costs are those type of a costs which are holding partially are completed assets and that do not qualify for a capitalization.

Capitalization of borrowing cost is not suspended when there is a temporary delay and it is a necessary part of the process of getting an asset ready for its intended sale or use.

For example, normally capitalization continues during the extended period when high water levels delay the construction of a bridge if such high water levels are common during the construction period in the geographical region involved.

Cessation of capitalization:

Capitalizing borrowing costs that should be cease when all of the activities that are necessary to prepare all the qualifying asset for its main intended use or a sale are complete.

Normally, an asset is mainly ready for it’s a intended use or a sale when it is the physical construction of the asset is a complete, even though a routine or a administrative that work might continue. If in this case of a minor modifications, such as decoration of a property to the purchaser’s or user’s specification, are all that is outstanding, this indicates that substantially all the activities are complete.

When an entity is completing the construction of a qualifying asset in parts, each part can be used. In contrast, construction can be continued on other parts. The entity should cease capitalizing borrowing costs when it substantially completes all the activities necessary to prepare that part for its intended use or sale.

E.g., A business park comprising several buildings, each of which can be used individually, is a qualifying asset for which each part can be used while construction can be continued on other parts.

For example, if a qualifying asset that needs to be complete before any part can be used is an industrial plant involving several processes carried out in sequence at different parts of the plant within the same site, such as a steel mill.

DISCLOSURE

In Ind AS 23 Borrowing Costs Accounting Standards Entities are required to disclose:

(a) The number of borrowing costs capitalized during the period.

(b) The capitalization rate used to determine the number of borrowing costs eligible for capitalization

OTHER RELEVANT CONCEPTS

Dividends which are payable on shares and classified as financial liabilities:

An entity might put investment in its operations in whole or in part by the issue of preference shares. In some cases, these would be classified as financial liabilities (as per Ind AS 32). Dividends that are payable on these instruments would be meeting the definition of borrowing costs, subject to the fulfillment of certain conditions.

Cost of capitalizing borrowing in group financial statements:

There might be a situation when the borrowings are taken by one company, and another company develops a qualifying asset within a group.

It may be appropriate to capitalize interest in the group financial statements on borrowings that are appearing in the financial statements of a different group of entity from there they might be carrying out the development.

As based on the underlying principle of Ind AS 23, capitalization in such circumstances would only be appropriate if the amount capitalized can be fairly reflecting the interest cost of the group on borrowings from third parties that can be avoided if the expenditure on the qualifying asset was not made.

However, the entity who is carrying out the development shouldn’t capitalize any interest in its financial statements as it has no borrowings.

If, however, the entity has intra-group borrowings, then interest on such borrowings may be capitalized in its financial statements.

Cessation of capitalization for maturing inventories:

For maturing inventories, in Ind AS 23 Borrowing Costs Accounting Standards it is sometimes difficult to determine when the ‘period of production’ ends, i.e., when inventories are being held for sale instead of being held to mature.

If this cannot be demonstrated, then the inventories should be regarded as held for sale, and no further borrowing costs should be capitalized.

My Name is Nadeem Shaikh the founder of nadeemacademy.com. I am a Qualified Chartered Accountant, B. com and M.Com. having professional and specialize experience in field of Account, Finance, and Taxation. Total experience of 20 years in providing businesses solution in Taxation, Accounting, and Finance with all statutory compliance with timely business performance Financials reports. You can contact me on nadeemacademy2@gmail.com or contact@nadeemacademy.com.