What is Profit & Loss (PnL) and how can it be defined?

A profit and loss statement which is know as P&L) is a financial statement that summaries the revenue, expenses, and costs for a specific period. It is usually a quarter or year. The P&L statement can also be referred to as the income statement.

Deeper definition of PnL

The profit and loss statement helps managers understand the flow and fluctuations of earnings and expenses. Investors and creditors consult company or entity P&L when assessing the risk of investing in a venture or lending capital to a company. This statement is complete records gains and losses earned by entity in a given period.

Public companies must produce three financial statements for public disclosure each quarter and annually:

- Balance Sheet statement

- Profit-and-loss statement, and

- Cash flow statement

What is PnL full form or what does pnl stand for ?

Ans. Profit and Loss Account / Profit and Loss Statement

What is P&L statement is also known as ?

Ans. P&L statement is also known as Net Income Statement

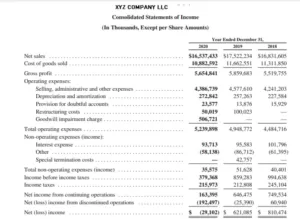

Below is the example of Profit and Loss PNL Templete

Private companies produce PNL profit and loss statements regularly for internal management and investors.

Two accounting methods can be used to build a profit-and-loss statement. The simple, one-step approach allows a business to add revenues and subtract expenses to arrive at the bottom line.

The multi-step method is more complex and involves subtracting operating expenses from revenue to generate operating income. The net of non-operating revenue, non-operating costs, investment gains, and losses is then added to your operating income, which will give you pre-tax income. After deducting a income taxes, you have net income.

What is P&l meaning or Pnl meaning ?

A profit and loss (or also known as income statement) is a financial statement that summarizes a company’s revenues and expenses over some time. The P&L statement demonstrates a company’s ability generate sales, manage expenses and create profits. It is also based on accounting principles, including revenue recognition, matching, and accruals. This makes it distinct from the cash flow statement.

These records give information about a company’s ability to increase revenue or reduce costs, or both. The P&L statement can be a statement about profit and loss, income statement or statement of operations, statement or financial results or income, earnings statements, or expense statement.

Non-profit organizations generally track revenues and expenses in a financial report called “Statement of Financials Activities” (also known as the on of Statement of Financial Activities or Statement of Support).

P&L management is the way a company manages its P&L through revenue and cost management.

The company’s profit and loss statement is usually presented over some time, such as a month, quarter, or fiscal year.

What is a profit and loss statement ?

The profit and loss statements provide summary information on revenue and expenses. These statements are generated according to the business’s standard operating procedure. They can be generated weekly, monthly or quarterly.

A P&L report’s basic formula is: Revenue less Expenses = Profits

Question many ask :-

What does the Profit and Loss Statement tells us ?

Profit and loss reports are important financial statements that accountants and business owners use. This report provides information about your net profit, based on your expenses and revenues. The report details the business’ ability to reduce costs and drive revenue.

You can also examine revenue and expense trends, net income, and cash flow to determine the best way to allocate resources and budgets. The IRS requires you to create a profit-and-loss report to calculate taxes on business profits.

How to Calculate Profit

Here are some of a simple steps to determine the net profit or loss of your business.

Gross profit = Net sales (after deducting sales return) – Cost of sales.

Net Operating Profit = Gross Profit + Operating Expense

Net Profit before taxes = Net Operating Profit + Other Income + Other Expense.

Net Profit (or loss) = Net profit before taxes – Income taxes

Sample Profit and Loss Report

The header of a P&L contains the name of the business and the accounting period. The header is followed by:

- Income

2. Expenses

3. Net Profit

The P&L lists the following main categories:

Revenue (or Sales)

Cost of goods sold (or called as cost of sales)

Selling, General & Administrative (SG&A), Expenses

Marketing and advertising

Technology/Research & Development

Interest expense

Taxes

Net Income

How to create a profit and loss statement ?

You can also have to decide on how often you want to run a profit and loss statement. Some companies prefer to have one monthly, while others prefer quarterly profits and loss statements.

No matter what your preference is, using accounting software will allow you to create a profit-loss statement. You can also use a defined Pnl template to create your profit and loss statements if you don’t have accounting software.

These are lot of the steps you need to follow to create a profit-and-loss statement for your company.

Step 1: Calculate the revenue for P and L

To create a profit-and-loss statement, you must first calculate the revenue received by your business. Current account balances can be retrieved from your general ledger. This includes cash and receivable balances.

When you create a monthly profit-and-loss statement, you will include all revenue received during that period. Whether or not your business has earned it. If you choose to create a quarterly profit and loss statement, add the revenue received over those three months.

Be sure to include all revenue earned, regardless of whether it comes from the sale of products or services when calculating revenue.

Step 2: Calculate the cost of goods sold.

A key part of any profit or loss statement is the cost of goods sold. You will need to include the cost of buying wallets from the manufacturer if you are selling them.

You will need to include all materials and supplies required to make the wallets. You must include the cost of the services you are selling, as well as the time and effort that you or your employees spent.

Step 3: Add the cost of goods sold to revenue to calculate gross profit

After determining your revenue and cost of goods, you can subtract the cost to get your gross profit. Gross profit is the amount your business makes from selling products and services.

Revenue = Cost of Goods Sold = Gross profit/Loss

Step 4: Calculate operating costs

Next, calculate all your operating expenses. Rent, travel, payroll, and equipment are all examples of operating expenses.

Step 5: Add operating expenses to gross profit to get operating profit

After you have calculated your operating expenses, subtract this total to get your total operating profit. This will show you your operating profit or loss.

Gross Profit – Operating Expenses = Operating Profit/Loss

Step 6: Increase your operating profit by adding additional income

You should include any additional income, such as dividends or interest income, not included in the revenue figures above. The total earnings before interest taxes, depreciation, and amortization (or EBITDA) is what you add to your operating profit.

EBITDA = Operating Profit + (Interest Income + Dividends Earned)

Step 7: Calculate interest and taxes, depreciation, amortization, and amortization.

Next, calculate interest payments, taxes due, as well as depreciation, amortization, and other expenses.

Step 8: Add interest, taxes, and depreciation to EBITDA to calculate net profit

The final step is to subtract interest, taxes, and depreciation from your net income or net profit.

Net Profit/Loss = EBIDTA – (Interest + Taxes + Depreciation)

What can a P&L statement reveal about your business?

You can see how your existing business is performing by looking at a profit and loss statement. A profit and loss statement is often used to assess the strengths and weaknesses of businesses.

Profitability of your products and services

Gross profit is a basic key indicator of your business’ success. We all want to make money, so it’s not surprising that gross profit is one of the most important indicators. The cost of goods sold is to be subtracted from the revenue to calculate your gross profit.

This number will basically tell you how good your services or products are. Look at increasing your sales if you have a low gross profit.

How your business is trending in a positive direction ?

You must look at trends when reviewing your profit-and-loss statement. Whether you calculate profit or loss monthly or quarterly, comparing reports can help you see how your business is trending.

If your January net profit was $11,000 but fell below $5,000 in February, March, and April, then you will need to take a deeper look at your finances to find out what happened. First, you need to examine gross profit. You should increase sales if gross profit is low.

If gross profit is stable but net profit drops, it means that operating expenses have increased. It would help if you started to look at ways to reduce expenses. Comparing profit and loss reports can prove more useful than one.

Pnl tells How well your company is doing overall ?

The bottom line. Investors and financial institutions will look at the bottom line when you hand over financial documents. Although a loss is not necessarily the end of the universe, it can indicate something wrong, whether it is a temporary issue or across the business.

In either case, the profit-and-loss statement allows you to see where your business stands in terms of profit. This will allow you to take a better business decisions.

Best accounting software to create profit and loss statements

Although it is not difficult to find a template for a profit-and-loss statement, using accounting software will make the process much simpler.

You can create a profit-and-loss statement by simply tracking the revenue and expense information using accounting software.

QuickBooks Desktop

QuickBooks Desktop is an accounting software option that works well for growing and small businesses. You can choose from three plans and easily upgrade to the next one as your business grows. QuickBooks Desktop’s latest version offers improved system navigation and more help options.

QuickBooks Desktop provides top-quality reporting capabilities, including several versions of the profit or loss statement. Reports can easily be customized and exported to Microsoft Excel for additional customization if required.

QuickBooks Desktop offers three plans.

Pro: The Pro plan costs $299.95/year and can support up to three users.

Premier: The Premier plan includes industry-specific reporting options. It costs $499.95/year and can support up to five users.

Enterprise: This plan is best for businesses that are actively growing. It is $849.10/year and can support up to 30 users.

FreshBooks

FreshBooks is an accounting software for a small type of businesses that provides a wide range of features, primarily aimed at sole proprietors or very small businesses. Freshbooks allows you to collaborate with contractors, employees, and accountants online and via a mobile app that can be used on both iOS and Android.

FreshBooks provides the information necessary to help sole proprietors make informed business decisions.

FreshBooks offers four plans. All include product support and strong reporting capabilities.

Lite: The Lite plan costs $15/month and provides support for up to five billable clients.

Plus: The Plus plan costs $25 per month and provides support for up to 50 clients.

Premium: The premium is $50/month and can support up to 500 billable customers.

Select: The Select plan can be customized priced and provides support for more than 500 clients.

OneUp

OneUp is an accounting software program that’s affordable and easy to use. It’s great for freelancers, sole proprietors, and small business owners. OneUp is available on the cloud and works on all devices, including mobile phones, laptops, laptops, etc.

OneUp’s unique feature is its ability to manually enter transactions or connect with a bank to automatically post-transaction. OneUp’s financial dashboard is great for small businesses. It provides a clear view of your business profit and cash flow.

OneUp’s pricing structure, which includes all features, is unique. It is based on how many users the system has, and there are five options:

Self: The Self plan costs $9/month for single users and includes no product support

Pro supports two users, costs $19/month, and includes unlimited support

Plus: Supports up 3 users, runs $29/month, unlimited support

Team: Supports up 7 users, $69/month, unlimited support

Unlimited: Unlimited for 8 or more users $169/month with unlimited support

The Blueprint has a comprehensive list of accounting software programs.

Let’s end with a word about the profit-and-loss statement

A profit and loss statement is essential for any small business. It’s the best report to see if your business is financially sound.

A profit and loss statement is required by investors and lending institutions alike. It can help you identify areas of success and spots that may require additional support.

What is profit and why is it so important?

Profit is an excellent lens to examine the financial health and performance of your company. It can be difficult to know if your business is actually making money if there’s a lot of capital flowing in and out. This can be explained more clearly with a profit and loss account. You can move on to the next stage of your business when you make a profit.

What are the limits of profit and loss accounts ?

P&L management can provide a great insight into your business’s profitability, but it won’t tell you everything about your business. A profit and loss statement won’t give you visibility into your company’s cash flow as it builds stock. It is important to create a cash flow statement and balance sheet alongside your profit and loss accounts.

What is the actual purpose of profit and loss statements?

All profit and loss statements have a common format. They start with an entry for revenue. This is also known as one of the “top line”. Next, revenue is subtracted from the cost to do business, which includes operating expenses, tax expenses and interest expenses. The net income (also known as profit) is the difference between the bottom line and revenue. You can search the internet for profit and loss statements templates and examples you can use to start your own business.

Statement on profit and loss vs. balance sheet

The P&L is only one of the financial statements that is essential for understanding the performance of your business. The balance sheets, which list the assets and liabilities of the company as well as the equity owned by the owner, are equally important. They can be dated at a specific date, such as December 31.

The balance sheet reveals, among other things, how leveraged a company is (i.e., how much debt it has). It’s also helpful to keep a cash flow statement. This shows how much money is coming in and out of the company to ensure that there are enough funds to pay its bills. The P&L, which shows a company’s ability to profit, is the most important financial statement.

It is easy to prepare the PnL statement or any other financial statement. If the company has an accounting system, it can keep track of revenues, expenses, and other key numbers and generate reports as soon as they happen.

My Name is Nadeem Shaikh the founder of nadeemacademy.com. I am a Qualified Chartered Accountant, B. com and M.Com. having professional and specialize experience in field of Account, Finance, and Taxation. Total experience of 20 years in providing businesses solution in Taxation, Accounting, and Finance with all statutory compliance with timely business performance Financials reports. You can contact me on nadeemacademy2@gmail.com or contact@nadeemacademy.com.

Thanks for systematic explanation on P&L.Would love to hear more such information to develop more insights on P&L statement generation and analysis

regards

Thanks we will surely do insight analysis soon.