What is Financial Preparation and Evaluation (FP&A)?

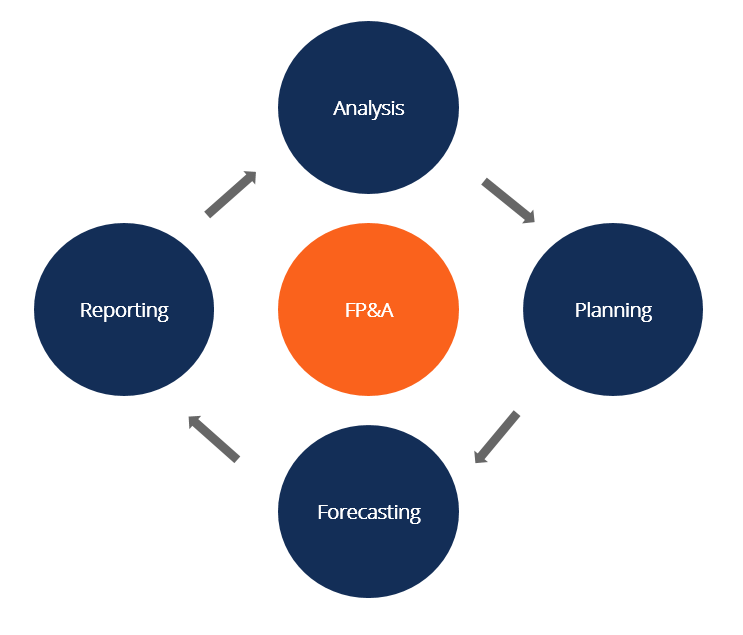

Financial Planning and also Analysis (FP&A) interplay an essential duty in business by performing budgeting, forecasting, as well as analysis that support major business decisions of the CFO, CEO, as well as the Board of Directors.

Very few, if any kind of, firms can be constantly rewarding and also grow without careful financial planning as well as capital monitoring. The job of managing a company’s capital normally is up to its FP&A team and its Principal Financial Officer (CFO). Learn more regarding the function of the CFO.

Company economic planning as well as monetary expert experts utilize both measurable and qualitative analysis of all operational elements of a company in order to assess the business’s progress towards attaining its objectives as well as to map out future goals as well as plans.

FP&A Analysts take into consideration economic and organization patterns, review previous company efficiency, and also attempt to anticipate barriers and also prospective problems, all with an eye towards anticipating a firm’s future monetary outcomes.

FP&A specialists manage a wide array of financial affairs, including income, expenses, taxes, capital expenditures, financial investments, and financial declarations. Unlike accounting professionals that are in charge of recordkeeping, economic experts are charged with checking out, assessing, and also examining the entirety of a corporation’s monetary activities, as well as mapping out the company’s monetary future.

The Top 10 Functions of Business FP&A

Right here is a listing of the Top 10 obligations that lie on the shoulders of economic preparation as well as evaluation (FP&A) experts:

Assessing whether the business’s existing properties and investments are the best use the company’s excess functioning resources, by taking a look at return on investment (ROI) and contrasts with various other ways the company may use its cash flow (e.g., other feasible financial investments, raised supply rewards, etc).

Gauging the firm’s overall monetary health, largely by utilizing crucial financial ratios such as the financial debt to equity ratio, existing ratio, as well as passion protection ratio.

Identifying which of the firm’s products or line of product generate the biggest part of its net earnings.

Recognizing which products have the highest possible earnings margin (as well as which have the most affordable)– It is a separate questions from the one detailed above, as item( s) that bring the highest possible revenue margin may not always be those that generate the best amount of total earnings– An easy example: Product A might lug a greater profit margin than Item B, however the company might sell substantially more systems of Product B.

Examining and also evaluating the cost-efficiency of each department of the company, due to what percent of the company’s financial resources each division consumes.

Collaborating with private divisions to prepare spending plans and consolidate them into one total corporate budget.

Preparing internal reports for executive leadership as well as supporting their choice making.

Developing, upgrading, and maintaining monetary designs as well as comprehensive forecasts of the business’s future operations.

Contrasting historical outcomes against budget plans as well as forecasts, as well as doing variance evaluation to describe differences in performance as well as make improvements going forward.

Considering opportunities for the business to expand or expand. Mapping out development plans, including capital expenditures and also investments. Getting 3- to five-year monetary projections.

In the end, a company’s financial analysts are expected to offer top monitoring with analysis and also suggestions concerning exactly how to a lot of efficiently utilize the business’s funds to enhance earnings as well as expand the firm at an optimal price, while staying clear of putting the company at major economic danger.

How to Figure Out if FP&A Job is Right for You.

Good economic analysts are people with the ability of taking care of as well as smartly assessing a mountain of different kinds of data and data evaluation metrics.

Monetary experts are good issue solvers. They have the ability to analyze the numerous puzzle items that constitute a business’s finances and also visualize placing the assemble to develop a selection of feasible growth scenarios.

If you simply don’t like mathematics or dealing with spread sheets like Excel, you may want to think about an alternating career selection.

However, if you’re an innovative issue solver, with a natural or grown skill for monetary analysis, modeling, and also forecasting, after that coming to be a corporate economic expert may be the excellent profession option for you.

To see if a financial planning and also evaluation job is right for you, discover our Interactive Profession Map.

Potential Income and also Income for FP&A Professionals– $50k to $1 million.

People who succeed at the job of examining business funds and also properly recognizing what monetary relocations a business should make in order to be ideally effective in an ever-changing market are well paid for their abilities.

Entry-level junior experts regulate yearly incomes in the neighborhood of $50k. Elderly experts can see an income of up to $100k, usually combined with possible benefits of 10-15%. A financial preparation as well as analysis manager or supervisor, as well as the Chief Financial Officer (CFO) at a significant, multi-national company commonly make someplace between 6 and also 7 figures in income, supplemented with sizable performance rewards.

Settlement in the financial evaluation area varies significantly between different sectors and companies. Clearly, larger companies with larger earnings can pay for to pay more than a smaller sized company whose complete net revenue could not also get to seven figures.

Benefits are usually very depending on the business’s profits and/or the expert’s skill in making accurate financial projections. (Naturally, this can potentially lead to troubles if an expert creates extremely conventional development techniques created primarily to ensure that profit targets are just hit instead of taken full advantage of.).

Placements in corporate money are predicted to see annual task growth upwards of 20% through the mid-2020s.

Decision Making and Finding Out Skills.

Although financial experts have to review a number of complex economic alternatives and scenarios, they need to likewise can making firm decisions, having the ability to avoid having a large variety of financial selections immobilize them right into uncertainty.

The wish to constantly find out is a vital individual stamina for monetary experts. As organizations, markets, and economic climates change as well as adjust, so, too, need to experts continuously change and adjust. Along with honing financial skills and also strategies, they are needed to stay on top of organization, industry, and also economic trends. The most effective experts are frequently learning more, becoming better as well as much better at what they do.

Checking Out and Assessing Economic Statements.

Business monetary preparation as well as analysis experts are a group that needs to be able to review and genuinely understand a business’s economic statements– balance sheets, capital statements, revenue statements, and also in the case of public firms, investors’ equity statements.

A good expert not only recognizes the significance as well as ramifications of each private financial declaration, but additionally sees the bigger image of exactly how a business’s overall economic placement is shown by the mix of properties, responsibilities, capital, as well as income.

A firm’s monetary analysis division needs to have an equivalent, otherwise far better, grasp of accountancy journal access as well as monetary settlement declarations than the accountancy division does. Experts need to understand the related aspects of debits and also credits and also be able to determine and examine essential financial proportions in order to establish where the company stands financially, as well as just how best to move on from there.

Job Administration Skills.

Economic experts are likewise economic planners. Their function is to, based upon research study, data collection, as well as data evaluation, recommend a firm’s monitoring on the most monetarily efficient ways of growing the business’s service and also revenues.

In assembling records such as three-year and also five-year monetary estimates, economic analysts are, fundamentally, constructing economic jobs. Great monetary experts often bring to the table excellent task management skills, such as management, expense as well as time management, the ability to pass on, communication skills– and overall analytic skills.

The majority of financial analysts are well-schooled being used programs such as Microsoft Excel to create and assess records. Executing business financial analysis consists of doing a great deal of data collection and also information debt consolidation, and afterwards generating various records with great deals of variables.

A lot of the job done by monetary analysts involves examining essential financial metrics, such as revenue margins, sales quantity, and supply turnover, and afterwards utilizing the analysis to develop tactical economic planning to move the business forward to the following degree of success.

Financial Modeling Operate In FP&A.

Experts, managers, supervisors, and also various other members of the FP&A group often carry out substantial economic modeling work, including producing, upgrading, and handling the business’s company version in Excel.

The corporate design is utilized for consolidating the budgets for all divisions, developing long-term forecasts, and also measuring real outcomes versus projections.

The outcome of the monetary version might be used in control panels, capitalist relationships discussions, board reporting, as well as ad-hoc analysis.

What Is Financial Preparation as well as Analysis (FP&A)?

Financial preparation as well as evaluation (FP&A) experts have the monetary planning, budgeting as well as projecting procedure at a company to notify major decisions made by the executive group as well as board of directors. These staff members collect, prepare as well as evaluate economic information from throughout the organization to create reports that give data-driven answers to business inquiries.

The FP&A feature is becoming increasingly positive. It’s utilizing finest techniques to focus not just on what took place or what’s happening however on why it’s occurring and what is likely to occur in the future.

An FP&A director or expert ought to be a service companion for the entire company, functioning closely with various service devices, and also a strategic advisor to the CFO or controller. These specialists help leaders of the finance department preserve and alleviate extra prices by identifying opportunities for efficiency, cost savings and investment.

The role of FP&A has evolved in recent years. In the past, FP&An experts focused on recording and reporting financial outcomes and also leveraging historic financial data to theorize future sales and revenues. However the flooding of information available today and also the technology that aids experts utilize it has actually equipped FP&A to move from more responsive job to giving insightful predictions and also analytics that directly influence business’s direction.

FP&A is distinct from accounting in that it concentrates on forward-looking data and also attempts to prepare for future results, while accounting testimonials past and also historical info to identify a company’s existing financial state.

FP&A Abilities.

An FP&An expert or director requires to succeed at math and have a cravings for grinding numbers. It’s therefore not a surprise that many individuals in this function are former accounting professionals. Yet experts in this area likewise require to be comfy diving right into facility as well as differed information sets from sales, advertising, personnels and also procedures.

Spreadsheets are a necessary tool in assessing that information, so FP&A workers require to be knowledgeable with Microsoft Excel or a comparable tool. They need to know the formulas and also procedures that will enable them to aggregate and control raw data to create vital records. They ought to recognize the fundamentals of ERP systems, understanding how this software application can automate coverage and also aid with more intricate coverage as well as evaluation.

Given that FP&A team members require to interact and collaborate with coworkers from throughout the company, they must have strong business partnering skills. Company partnering skills include the capability to function well with others and comprehend their business priorities and also objectives, construct a deep understanding of the firm and its procedures, and also turn droves of details right into quickly recognized records.

Finally, FP&A needs exemplary analytical skills, as these employees should get rid of the challenges inherent in consolidating and also fixing up financial information.

Is FP&A a good job selection?

Financial planning and analysis might be an excellent job selection if you take pleasure in the following:.

Complicated mathematics as well as number crunching.

Diving right into elaborate information collections from across the organization.

Operating in spreadsheets and making use of solutions to develop records.

Making use of computerized tools like ERP to aid analysis.

Connecting with companions whatsoever degrees throughout an organization.

Consolidating and reconciling economic data.

Below is an example of an economic design used in FP&A.

Education and learning and also Accreditations for Corporate Financial Experts.

Hopeful company economic experts can comply with a number of academic courses to success in the market. Degrees commonly held by analysts include accounting, service administration, stats, and also finance. The sensible post-graduate curriculum for financial analysts is an MBA degree.

CFI supplies professional FP&A programs, together with proceeding education and learning training, all online. Having a qualification from CFI aids with touchdown work, protecting promotions, and being able to regulate greater degrees of settlement.

Some business financial analysts additionally seek expert qualification in the field of investing, obtaining credentials such as Licensed Economic Planner (CFP), Financial Threat Manager (FRM), or Financial Modeling and also Assessment Analyst (FMVA).

Discover all CFI programs currently to start progressing your job!

Ideal Work Experience for Aspiring Financial Experts.

The most effective useful job experience beyond direct monetary evaluation job is anything that shows you’ve shown the ability to help a firm grow, especially in an inexpensive manner. That could be anything from increasing sales by doing a good window display screen, to decreasing overhanging prices via a complete revamping of a business’s inventory system.

Practically any basic company experience that highlights your capacity to solve troubles as well as boost success can be a significant and also on your resume’ when looking for work as a company financial expert.

Working at a financial institution or at a public accounting company can be a terrific method to enter FP&A.

FP&A Within a Corporate Structure (and also for Small Businesses).

In a small business, the setting of the business economic expert might not exist as a separate job title, but rather effectively be held by the proprietor, CEO, CFO, or business controller.

Larger companies have a full corporate economic analysis department, typically headed by either a Director of Financial Planning as well as Analysis or by the firm’s Principal Financial Officer (CFO). Some business have both placements, with the Director of Financial Analysis reporting to the CFO.

In a large corporate financial evaluation division, entry-level junior economic experts work in little groups headed by an elderly economic analyst. In the biggest, multi-national firms, junior experts are assigned to assess a solitary line of product, or possibly even a solitary item. As an example, if you worked as a junior analyst at The Hershey Business (NYSE: HSY), you could be appointed to generate all the pertinent records and also suggestions regarding just one sweet bar.

It normally takes about three to five years to make the change from a junior to an elderly financial analyst. Along the way, you could have the possibility to display your skills, getting designated the title of supervisor– in charge of a specific monetary job, such as altering the way the business does supply coverage or looking after a substantial capital expenditure job.

Financial Analyst Specialties.

There are numerous field of expertises readily available for company economic analysts. Some economic analysts at some point concentrate on managing business investments, while others use their skills exclusively to obtaining the required funding for development projects.

When taking a look at job opportunity as a financial analyst, consider what kind of function as well as atmosphere you ‘d be happiest and also most comfy in. Some people prefer a big company with clearly developed job courses and also the opportunity to gradually rise at a well developed firm. Others like the challenge helpful a smaller sized firm browse its way with a period of rapid growth, even if it requires using a great deal even more hats in regards to task obligations.

One considerable adjustment in the sector is the raised concentrate on economic regulative matters. The Sarbanes-Oxley Act of 2002 in the United States, in addition to other new, relevant legislation (as well as similar regulations in other nations) indicates that the financial workers in firms have to devote a lot more time and attention to meeting fiduciary as well as various other regulative responsibilities, such as increased reporting demands.

If you have actually got a present for taking care of federal government bureaucracies– specifically, regulatory authorities– that’s an useful skill asset in today’s corporate world.

To learn more, explore our cost-free Intro to Business Money course.

Blog Post FP&An Occupation– Where Can You Go Later– Departure Methods.

There’s a fair quantity of disagreement concerning existing leave chances within the company finance sector. However, there are some frequently taken a trip paths for professionals that have operated in monetary planning and also analysis.

A majority of business monetary analysts remain in the industry yet go after new difficulties (and higher wages) by relocating from one company to another.

Around 10% of business monetary analysts eventually shift themselves right into the areas of either investment banking or private equity. Another 10% relocation right into some other location of corporate monitoring, such as sales and advertising and marketing or personnels.

Around 20% of financial analysts end up entering into organization on their own, coming to be personal company specialists.

All-time Low Line– FP&A is an Essential Function with Major Opportunities.

Careers:.

Since the work of business financial evaluation encompasses such a broad series of tasks, as well as additionally due to the fact that the job is so seriously important to a company’s development and also fundamental monetary survival, business financial preparation and also evaluation (FP&A) is a career path that supplies a wide array of chances and higher than ordinary payment. With the correct skill set and also a natural inclination for the work, you can take an extremely enjoyable profession for yourself as a company monetary expert.

My Name is Nadeem Shaikh the founder of nadeemacademy.com. I am a Qualified Chartered Accountant, B. com and M.Com. having professional and specialize experience in field of Account, Finance, and Taxation. Total experience of 20 years in providing businesses solution in Taxation, Accounting, and Finance with all statutory compliance with timely business performance Financials reports. You can contact me on nadeemacademy2@gmail.com or contact@nadeemacademy.com.