What is Investment Banking?

Investment financial is the department of a bank or banks that offers governments, firms, and institutions by supplying underwriting (capital raising) as well as mergers and also acquisitions (M&A) consultatory solutions.

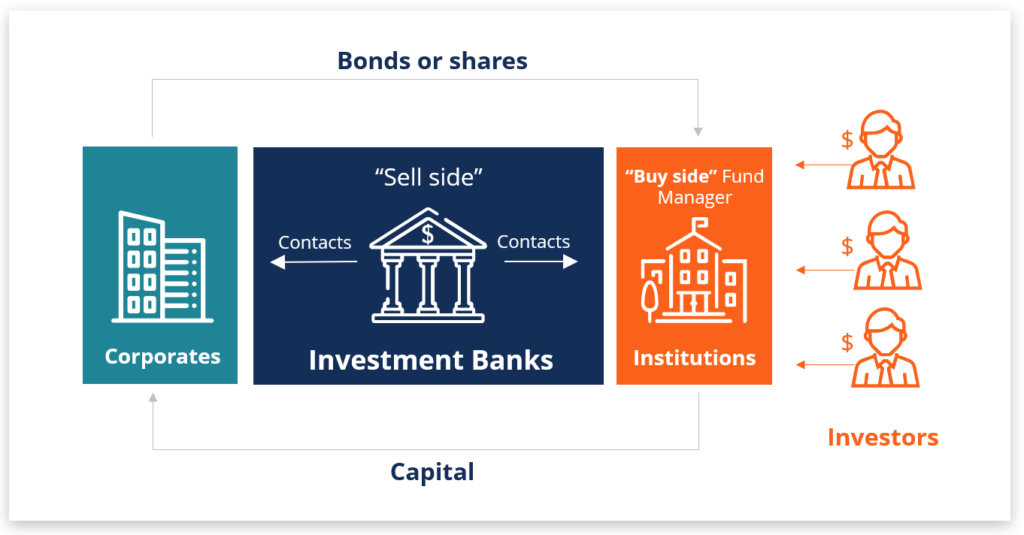

Financial investment banks work as middlemans in between financiers (who have cash to spend) and also companies (that need funding to grow and run their businesses). This guide will cover what financial investment financial is and also what investment lenders really do.

What Do Investment Banks Do?

There can often be complication in between an investment bank and also the investment financial department (IBD) of a financial institution. Full-service financial investment banks offer a vast array of services that consist of underwriting, M&A, sales and also trading, equity study, asset management, business financial, and retail banking. The financial investment financial division of a financial institution supplies just the underwriting and also M&An advisory solutions.

Full-service banks offer the following services:

Underwriting— Funding raising and also financing teams work in between capitalists and also firms that intend to raise money or go public via the IPO procedure. This function offers the main market or “brand-new resources”.

Mergers & Acquisitions (M&A)– Advisory duties for both buyers and also sellers of companies, taking care of the M&A process start to end up.

Sales & Trading-– Comparing customers and vendors of protections in the additional market. Sales as well as trading teams in financial investment banking serve as representatives for customers and likewise can trade the firm’s very own capital.

Equity Study-– The equity research study team research study, or “insurance coverage”, of safeties helps capitalists make investment choices and also supports trading of supplies.

Asset Management— Managing financial investments for a large range of investors including institutions and also individuals, across a variety of investment styles.

Financing Solutions in Financial Investment Banking

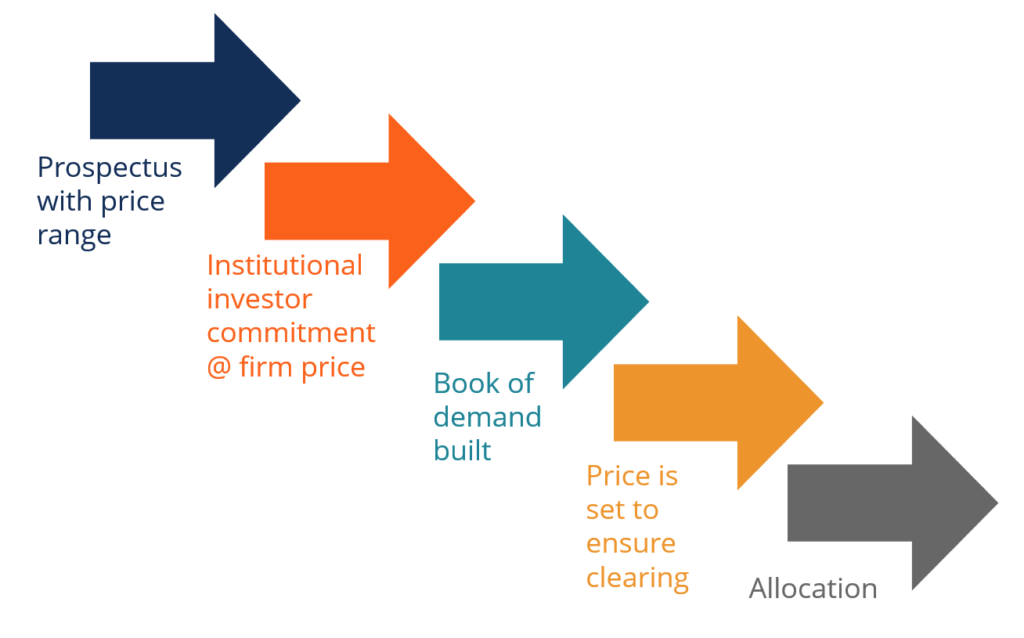

Underwriting is the procedure of raising resources with marketing stocks or bonds to investors (e.g., an initial public offering IPO) in support of companies or other entities. Companies require cash to run as well as expand their services, and the bankers help them obtain that money by marketing the firm to investors.

There are usually three sorts of underwriting:

Firm Dedication— The underwriter agrees to purchase the whole issue as well as presume full monetary responsibility for any kind of unsold shares.

Best Efforts-– Expert devotes to marketing as much of the concern as possible at the agreed-upon offering price however can return any kind of unsold shares to the issuer without financial responsibility.

All-or-None-– If the whole concern can not be sold at the offering price, the deal is aborted as well as the releasing firm gets nothing.

Once the financial institution has started marketing the offering, the complying with book-building actions are taken to cost as well as finish the deal.

M&A Advisory Solutions

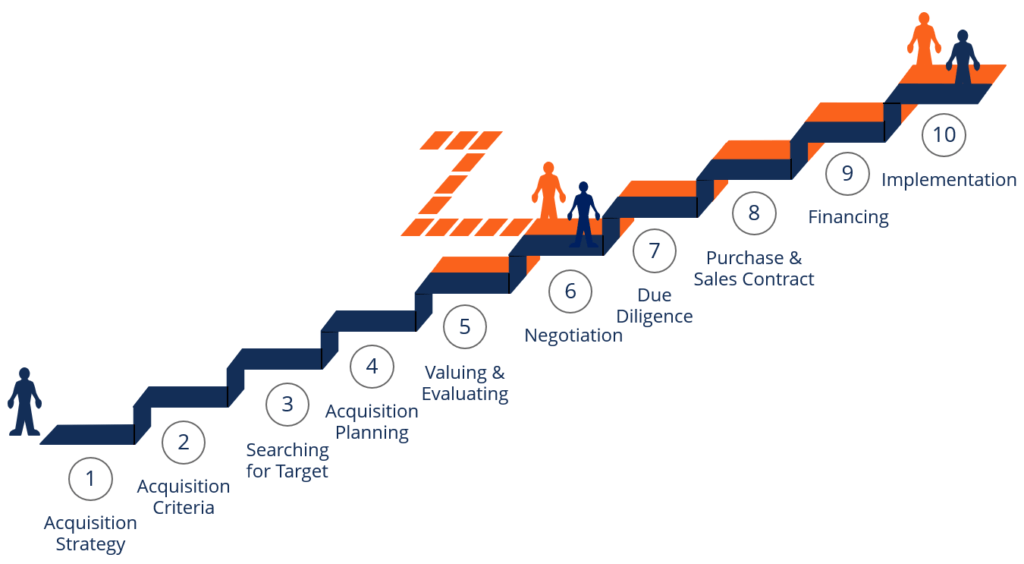

Mergers as well as acquisitions (M&A) advisory is the process of helping corporations and also establishments discover, review, and total acquisitions of services. This is a crucial function in i-banking. Financial institutions utilize their considerable networks and also partnerships to find possibilities and aid negotiate on their customer’s part. Bankers encourage on both sides of M&A deals, representing either the “buy-side” or the “sell-side” of the deal.

Below is a summary of the 10-step mergings and also procurements procedure.

Banking Customers

Investment lenders suggest a wide variety of clients on their capital raising and M&A requirements. These clients can be situated around the globe.

Financial investment financial institutions’ customers consist of:

Federal governments— Investment financial institutions deal with governments to raise money, profession safety and securities, as well as buy or sell crown firms.

Corporations-– Bankers deal with both private and also public business to help them go public (IPO), raise extra resources, grow their businesses, make procurements, offer organization devices, and supply study for them and also basic corporate financing guidance.

Organizations-– Banks work with institutional capitalists who handle other individuals’s cash to help them trade protections as well as supply research study. They additionally work with personal equity firms to help them obtain portfolio companies and departure those positions by either offering to a critical buyer or using an IPO.

Investment Banking Skills

I-banking work calls for a lot of economic modeling as well as evaluation. Whether for underwriting or M&A tasks, Experts and also Affiliates at financial institutions invest a great deal of time in Excel, constructing financial designs as well as making use of various evaluation techniques to advise their customers as well as full bargains.

Financial investment financial calls for the following abilities:

Financial modeling– Performing a variety of financial modeling tasks such as building 3-statement designs, marked down capital (DCF) designs, LBO versions, and various other types of economic models.

Organization valuation— Making use of a wide range of evaluation methods such as equivalent company analysis, precedent deals, as well as DCF evaluation.

Pitchbooks and also discussions-– Structure pitchbooks and also PPT presentations from the ground up to pitch ideas to prospective clients as well as win new organization (check out CFI’s Pitchbook Program).

Transaction files— Preparing files such as a secret information memorandum (CIM), financial investment teaser, term sheet, discretion agreement, building a data area, and a lot more (look into CFI’s collection of cost-free purchase themes).

Connection management-– Working with existing clients to successfully shut a deal as well as see to it customers are happy with the solution being offered.

Sales as well as company growth— Constantly conference with prospective clients to pitch them concepts, supply them sustain in their job, and also offer value-added guidance that will inevitably win brand-new business.

Arrangement-– Being a significant consider the negotiation methods in between purchasers and sellers in a transaction and assisting customers optimize worth production.

Occupations in Financial Investment Banking

Entering into i-banking is very difficult. There are even more applicants than there are placements, in some cases as high as 100 to 1. We’ve published a guide on just how to ace an investment banking meeting for more information on just how to break into Wall Street.

Furthermore, you’ll intend to take a look at our instance of real interview concerns from a financial investment bank. In getting ready for your meeting it likewise assists to take courses on monetary modeling and also appraisal.

The most common work titles (from most younger to senior) in i-banking are:

Expert

Associate

Vice President

Director

Handling Supervisor

Head, Vice Chair, or an additional special title

Who are the Key Investment Banks?

The primary banks, additionally referred to as the bulge brace financial institutions in investment banking, are:

- Financial Institution of America Merrill Lynch

- Barclays Capital

- Citi

- Credit score Suisse

- Deutsche Bank

- Goldman Sachs

- J.P. Morgan

- Morgan Stanley

- UBS

My Name is Nadeem Shaikh the founder of nadeemacademy.com. I am a Qualified Chartered Accountant, B. com and M.Com. having professional and specialize experience in field of Account, Finance, and Taxation. Total experience of 20 years in providing businesses solution in Taxation, Accounting, and Finance with all statutory compliance with timely business performance Financials reports. You can contact me on nadeemacademy2@gmail.com or contact@nadeemacademy.com.