Interim Financial Statements is applied for Reporting when an entity is preparing for an interim financial report. Ind AS 34 is not mandatory for an entity as to when to construct such a report.

Timely and reliable interim financial reporting also improves the ability of creditors, investors, and others for understanding an entity’s capacity to generate earnings and cash flows and its financial condition and liquidity.

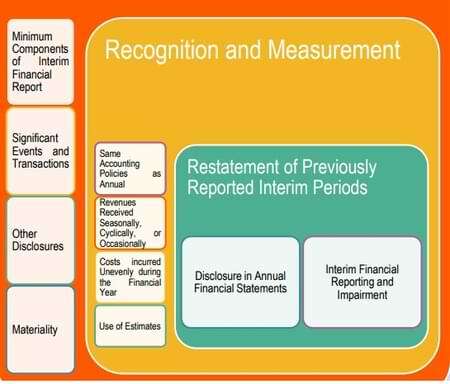

It permits less information to be reported than in annual financial statements (based on providing an update to those financial statements)—the standard outlines the recognition, measurement and disclosure requirements for interim reports.

Objective of Interim Financial Statements

The objective of this Standard is prescribed below:

- Minimum content in a report of interim financial.

- Various principles for recognizing and measuring incomplete or condensed financial statements for an interim period.

SCOPE Interim Financial Statements

- This Standard does not mandate that which entities is required for publishing interim financial reports, how soon, or how frequently after the end of a period of interim.

- This Standard is applied if an entity is required or elects to publish an interim financial report following Indian Accounting Standards.

- Each financial report which is annual or interim, is evaluated on its own for conformity to Ind AS. An entity might not provide interim financial reports during a particular financial year, or it may have provided the interim financial reports that is not complying with this Standard and does not prevent the entity’s annual financial statements from conformation to Ind AS if otherwise they do so.

- If an interim financial report of an entity is described as complying with Ind AS, it must comply with this Standard’s requirements.

DEFINITIONS of Interim Financial Statements

- Interim period of a financial reporting period can be shorter than a full financial year.

- Interim financial report can be a financial report which contains a set of complete financial statements or a set of financial statements which are condensed for an interim period.

- A balance sheet which is condensed.

- A statement of profit and loss which is condensed.

- A statement of changes in equity which is condensed.

- A condensed statement of cash flows.

- Comprising significant accounting policies and several other explanatory information.

An Interim Financial Report shall include, at minimum, the following:

- In the interest of cost considerations and timeliness and can avoid the repetition of information which is previously reported, an entity might be required or maybe elected for providing less information at interim dates as it is compared with its annual financial statements.

- The interim financial report can focuses on new circumstances, activities and events that does not duplicate information which is previously reported.

- Nothing in this Standard can be intended for prohibiting or discourage an entity from publishing a complete set of financial statements in its report of interim finance, rather than condensed financial statements and explanatory notes can be selected.

- Nor does this Standard prohibits or discouraged an entity from including condensed interim financial statements more than its minimum line of items or selected explanatory notes as set out in this Standard.

SIGNIFICANT TRANSACTIONS AND EVENTS

- An entity should be included in its interim financial report an explanation of events and transactions that are significant to understanding the changes in the financial performance and position of the entity from the end of the last annual reporting period.

- Information which have been disclosed concerning those events and transactions shall update the relevant information presented in the most recent annual financial report.

- An user of an entity’s interim financial report would have to access to that entity’s most recent annual financial report. Therefore, it can be unnecessary for the notes for an interim financial report to provide relatively minor updates to the information reported in the notes in the most recent annual financial report.

- Individual Ind AS guide disclosure requirements for many of the items listed above. When an event or transaction is significant for an understanding of the changes in an entity’s financial position or the performance is considered since the last annual reporting period, its interim financial report shall provide an explanation of an update of the relevant information which is included in the last annual reporting period of financial statements.

OTHER DISCLOSURES

It shall normally information be reported on a fiscal year-to-date basis. In addition for disclosing the significant events and transactions, an entity should include the information in the notes for its interim financial statements.

The following disclosures should be given either in the interim financial statements or it can be incorporated by the cross reference from the interim financial statements.

For some other statement that is available for the users of the financial statements on the same terms as the interim financial statements and at the particular same time.

If the users of the financial statements is not having access to the information incorporated by cross-reference on the same terms and simultaneously, the interim financial report is incomplete.

THE PERIODS FROM WHICH INTERIM FINANCIAL STATEMENTS ARE REQUIRED TO BE PRESENTED

Interim reports should include interim financial statements for periods as follows:

(a) Balance sheet from the end of the current interim period and a comparative balance sheet from the end of the financial year which can be immediately preceded.

(b) For the current interim period and cumulatively for the current financial year to date statements of profit and loss with comparative statements of profit and loss for the comparable interim periods of the immediately preceding financial year.

(c) Cumulatively, statement of changes in equity for the current financial year to date, with a statement which can be comparative for the comparable period of year to date of the immediately preceding financial year.

(d) Cumulatively, statement of cash flows for the current financial year to date, with a comparative statement for the comparable period of year to date of the immediately preceding financial year.

For an entity who is running a highly seasonal business, financial information for 12 months up to the end of the period of interim and comparative information from the prior 12 month period may be useful.

MATERIALITY in Interim Financial Statements

- In decision of how to recognize, measure, classify, or disclose an item for interim financial reporting purposes, materiality shall be assessed concerning the interim financial data.

- In creating the assessments of materiality, it shall be recognized that interim measurements might be relying on the estimates of a greater extent than measurements of annual financial data.

- While there is always a requirement of judgment for assessing materiality, this Standard can be the basis of the recognition and disclosure decision on the data of the interim period by itself for understandability of the interim figures.

- Changes in accounting policies, unusual items or estimates, and errors are recognized and disclosed based on materiality concerning interim period data to avoid misleading inferences that might result from non-disclosure.

DISCLOSURE IN ANNUAL FINANCIAL

- If an estimate of an amount is reported in an interim period can be changed significantly during the final interim time of the financial year, but a separate financial report cannot be published for that period of final interim, the nature and value of that can change.

- The estimate that should be disclosed in a note of the annual financial statements for that particular financial year.

- If practicable, then the Ind AS 8 requires disclosure of nature and the amount of a change can be estimated that either it is having a material which is effecting in the current period or it is expected to have a material effect in subsequent periods.

- An entity is not required for including additional interim period financial information in its annual financial statements.

PREVIOUSLY REPORTED INTERIM PERIODS RESTATEMENT

A change in policy of accounting, other than one for which a new Ind AS specifies the transition, should be reflected by:

(a) Restatement from the financial statements of the interim periods of prior the current financial year and the comparison of interim periods of any prior financial years that can be restated in the annual financial statements following Ind AS 8.

(b) When it is determined it can be impracticable to the cumulative effect at the beginning of the financial year for applying for a new accounting policy. For all prior periods, adjustments of the financial statements of prior interim periods of the current financial year, and interim periods.

This can be comparable of prior financial years to apply the new accounting policy prospectively from the earliest date practicable.

Under the rules of Ind AS 8, a change in accounting policy can be reflected by retrospective application, with the restatement of prior period financial data as far back as is practicable.

However, suppose the cumulative amount of the adjustment relating to prior financial years is impracticable to determine, then under Ind AS 8. In that case, the new policy is applied prospectively from the earliest date practicable.

The effect of this along concerning interim periods should be that, it should be within the current financial year, any kind of change in accounting policy can be applied either retrospectively or it can be practicable, prospectively, from no later than the beginning of the financial year.

INTERIM FINANCIAL REPORTING and Interim Financial Statements

An entity is required for assessing goodwill for impairment at the end of each reporting period and, if required, to recognize an impairment loss at that date following Ind AS 36.

However, when the subsequent reporting period ends, conditions may have changed that an impairment loss would be reduced or have been avoided the impairment assessment been made only at that date.

Accordingly, an entity shall not reverse an impairment loss recognized in a previous interim period regarding goodwill.

My Name is Nadeem Shaikh the founder of nadeemacademy.com. I am a Qualified Chartered Accountant, B. com and M.Com. having professional and specialize experience in field of Account, Finance, and Taxation. Total experience of 20 years in providing businesses solution in Taxation, Accounting, and Finance with all statutory compliance with timely business performance Financials reports. You can contact me on nadeemacademy2@gmail.com or contact@nadeemacademy.com.