What are Credit Sales?

There are two types of Sales. One is Cash Sales and another is credit Sales.

CASH Sales:- Any goods or services which are sold in Cash or thru checks and prompt payment is received from the customer are Cash Sales.

Credit sales:- It refers to the sale in which the amount is owed it will be paid at a later or defined date. Credit sales are purchases that are made by customers or clients who do not make payment in full of the goods or services, in cash, or at the time of purchase.

Credit sales are mainly purchases that are made by customers for which a payment is mainly delayed or at the defined time. These Delayed or short payments or credit are allowed to customers. This is basically to generate a relationship with a customer for the purchase of goods or services. Thus mainly it is used to pay back the seller.

Thus, there is a reasonable delay in payment which is allowed to customers to make additional purchases. This use of credit sales is mainly a key competitive tool that is a practice in companies, where there are longer payment terms that can be used to mainly attract additional customers.

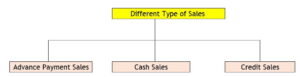

Different types of Sales Transactions

There are mainly record three types of sales transactions such as cash sales, credit sales, and advance payment sales. The basic difference between these two sales transactions simply lies in the timing of when cash is received to the Seller.

1. Cash sales: Cash is collected immediately when a sale is made and goods or services are mainly delivered to customers.

2. Credit sales: Customers are allowed a time or a credit period after a sale is made to pay to the seller.

3. Advance payment sales: Customers mainly pay the seller in advance before a sale is made. Prompt payment is taken once the item is booked.

How to mainly Record a Credit Sale?

Company A sold bags to Neil on credit on 1st January 2020 in the USA. The amount owed is $200, due on 15th Feb 2020. On 3rd Feb 2020, Neil made the full payment of $200 for the bags.

| Date | Account Title | Debit | Credit |

| 01-Jan-20 | Accounts Receivable (Neil) | $200 | |

| Sales | $200 | ||

| To record the sale of bags to Neil on credit | |||

| Date | Account Title | Debit | Credit |

| 3rd-Feb-20 | Cash | $200 | |

| Accounts Receivable (Neil) | $200 | ||

| To record Amount received on sale of bags | |||

Where does comes sales credit in the final account?

If we consider the above example in the Final Account Sales credit will be reflected in the credit side of the profit and loss account statement. It will be included in the turnover.

In the Balance sheet, it will be under Account receivable. If we are preparing financial accounts for 31st Jan20 if will have the below figure in the profit and loss account and Balance Sheet.

Where does comes sales credit in the final account?

If we consider the above example in the Final Account Sales credit will be reflected on the credit side of the profit and loss account statement. It will be included in the turnover.

In the Balance sheet, it will be under Account receivable. If we are preparing financial accounts for 31st Jan20 if will have the below figure in the profit and loss account and Balance Sheet.

Manage Credit Sales very efficiently

Successful closure of a credit sale is determined only when you convert your sales into cash. Till your sales are been converted into cash, you will need to mainly manage how much you will need to receive?’ from to whom? And to when?

This is critical for a business because credit sales are nothing but the money that is yet to enchased from customers and it is mainly referred to as Accounts Receivables.

Accounts receivables are only one of the key sources of estimating cash inflow, any inefficiency in basically managing accounts receivables will also impact a business in several ways and potentially hamper of growth of the business.

Here are Four Tips for mainly increasing efficiency in managing accounts receivable and by reducing your order to a cash cycle.

Invoice by invoice a Receivable Management

Here, an invoice by invoice refers to the tracking of each sales invoice and mapping with a subsequent receipt to be received from the customer. This may be thru debit card and credit card. Thus, at any point, you can easily track bills pending instead of just knowing only the overall outstanding of your customers.

Aging analysis

The longer your invoice sits on accounts receivable, will be lead to cash flow issues, and at a point in time, it may be turned into bad debt. Thus, it is very important for you to top of aging of each invoice. This will helps in basically identifying invoice which is mainly pending from a long-time and ones which will require immediate action.

Payment a Performance and a periodically following up

A Payment Performance of customers is an average in time by the customers it takes up to pay the bills in irrespective of an outstanding balance as on the statement date. This mainly also be known as a receivable turnover in a day. This will helps mainly to identifying that the customers with be a poor track of record and mainly accordingly action.

Internal Credit Control Techniques

To mainly ensure that better credit management, you will define a maximum Credit type of Limit based on credibility, The volume of any transactions, the main capacity of repayment. for your customers. This will mainly help you to know a business owner in an overselling to the customer beyond mainly defined credit limits.

While will sound true, automating accounts receivables is a process using mainly accounting software that will be key for a company or businesses. Accounting software mainly helps in ease you to manage your receivables, It is easy to track pending invoices and a real and actual time of the status of your receivables and aging of invoice.

What are Net Credit Sales?

Net credit sales mainly refer to the number of amount sales on a done on credit after basically deducting or subtracting sales returns done by customer and sales allowances are given to customers. Sales return the main merchandise that is returned to the company by customers. If any product is got sold on credit and is returned, its worth should be get deducted while we are calculating the worth of net credit sales.

Sales allowance is basically a reduction in the part original decided selling price this is due to a delivery problem with the incurred sale transaction. If take for example if any sales allowance is granted to a client or customer who had purchased a product or services at a higher or increase price mainly due to pricing over charged error.

Where a Net Credit Sales appear in Accounts?

The Net credit Sales appear on the credit side of the Profit and loss account. After deducting the Sales return and Sales Allowance.

2nd impact will be after reducing the Account receivable party account. And standing the net amount is due from the customer or client.

Net Credit Sales Formula

Net Credit Sales Advantages

-

It Provides Break-up:

Net credit sales would be mainly done to provide us a perfect type of picture through a proper break up for values between sales returns and also proper sales allowances. Thus it will thereby also helping a company to mainly know and understand a correct type of a picture of amount that will is going realized during any of a particular period.

-

Control on Receivables:

By just keeping a complete watch on net credit sales of any company. It helps management to mainly closely control and completely monitor total receivables that are expected to mainly receive. An increase in the same would be stand to mainly creating cash or liquidity problems for the company and will thus help management to become very cautious in case of receivable.

-

Compatible of Ratios:

Thus it helps a company mainly to understand the outstanding total receivables it has. This receivable is basically after it is considering any deduction from credit sales.

It helps companies to mainly gauge cash ratio or liquidity ratios that it is having currently. It may happen to know that ratios are decreasing. It alarms as a signal for the company.

Hence it also facilitates ratios as the company desire, and any type of deviation or any discrepancy will know the management take timely action which is required for the business.

-

Creation of Ledger:

The company may tend basically create Account receivable in the name of each and every customer. It will be thereby keep a track of associated the amount with each of the customers. that are linked.

These are actions that mainly smooth unnecessary creation of a ledger in books of account thus prompting any company to mainly take necessary and collective action which is against required for a client or a customer from whom this amount stands is overdue in ageing.

-

Goes into Ratio Analysis:

An essential part of mainly having to basically calculate ratios such as ratios of Turnover receivable ratios. As net credit sales, which is credit sales after by deducting any of sales returns from client or customers. It goes on the numerator which is then by dividing receivables to mainly achieve the Turnover receivables ratio.

- Credit sales credit good credit policies that give us competitive advantages to organizations.

- Such policies will help new startup organizations in order to increase sales.

- It also develops trust and a good relation between customers and the company.

- It also helps those clients or customers who are having the cash flow issue and make payment at the time of purchases, and the client or customer can make a payment after 15 days or thirty days as per the agreed credit term.

- Having a Longer time of credit days will attract new clients or customers.

Disadvantages Net Credit Sales

Delay in a Collection:

There may be incidents or times when we have certain addition from an additional debt through net credit sales this may create many cash flow and collection problems with a firm.

The Account receivable may not be necessary an amount in a time whereby it affecting the company cash liquidity of the company. Created cash flow issue is not a very good condition to have in a company.

Also know why Senior Accountant Salaries is increasing

Additional Expenses:

The amount that is waived off is due to sales returns which are given as per the agreed terms of service or any product which tends to accidental expenses for customers or a company, and this condition could be have been avoided if there were any type of scrutiny for outstanding an account receivable. You can also calculate Acid Test Ratio.

- This carry always a risk of having bad debt.

- It hit the cash flow of the company because of the payments received late than the purchaser will ask for payment. This will create a Cash flow issue.

- This leads companies to incur additional expenses on a collection agency for a timely and regular follow-up with clients or customers for their dues which are outstanding.

- The company will have to mainly maintain and keep separate books of accounts for an account receivable.

- There is many a time a notional loss of the amount of interest that may be earned during the credit period because of cash or fund is getting blocked during the credit period.

Also learn How to improve Quick Ratio Formula

CONCLUSION

Credit Sales is basically a type of Sales or a method of sales in which companies sell their goods to clients or customers on credit on the basis of the creditworthiness of a client or customers. It gives some time to customers to make payment after getting sold goods. It gives customers an opportunity to purchase goods or services. This make sales happen on an immediate basis.

It also helps small or new businesses, especially those who are not having enough capital. At the same time, it also helps big or large companies to attract the client or customers.

There is many a time risk of bad debts. That means if a client or a customer if not able to make a payment or a fraud or he/she is not traceable, then in such condition, it is will be very difficult mainly to get cash or money and it mage become a bad debt.

Credit Sales mainly increase the cost of working capital also it is because a client or customer giving any payment after a given time of 15 days or thirty days depends on the agreed credit terms. Such a condition company working capital is getting blocked by these days, and there is also a loss of interest. That is why is a very good option for new start-up companies or company who want to expand their business.

My Name is Nadeem Shaikh the founder of nadeemacademy.com. I am a Qualified Chartered Accountant, B. com and M.Com. having professional and specialize experience in field of Account, Finance, and Taxation. Total experience of 20 years in providing businesses solution in Taxation, Accounting, and Finance with all statutory compliance with timely business performance Financials reports. You can contact me on nadeemacademy2@gmail.com or contact@nadeemacademy.com.