What is the Circular Flow Model?

The round flow version is a financial model that provides exactly how cash, items, as well as services relocate in between industries in an economic system. The flows of cash between the sectors are likewise tracked to gauge a country’s nationwide income or GDP, so the version is likewise referred to as the circular flow of earnings.

The circular circulation model shows just how money relocates via society. Money flows from producers to workers as salaries and flows back to producers as repayment for products. In short, an economy is an unlimited round circulation of cash.

That is the fundamental kind of the version, however real money flows are much more made complex. Economists have included even more aspects to far better show complex contemporary economies. These aspects are the parts of a country’s gdp (GDP) or nationwide income. Therefore, the version is likewise referred to as the round circulation of revenue version.

Understanding the Round Circulation Model

The suggestion of round circulation was first introduced by economist Richard Cantillon in the 18th century and after that considerably established by Quesnay, Marx, Keynes, and also several other economists. It is one of the most standard ideas in macroeconomics.

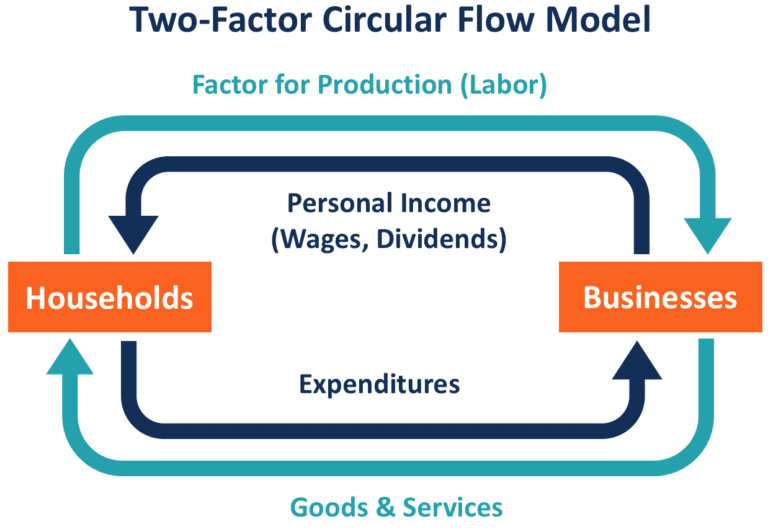

Exactly how an economic climate runs can be simplified as two cycles flowing in opposite directions. One is items as well as solutions flowing from services to people, and people supply resources for production (manpower) back to business.

In the other instructions, money moves from individuals to businesses as customer expenditures on goods and services and also flows back to individuals as individual earnings (earnings, returns, etc) for the labor force provided. This is one of the most fundamental round flow design of an economic climate. Actually, there are much more events taking part in a much more complex framework of circular circulations.

Circular Circulation Designs with Fields

Two-Sector Version

The design defined above is the two-sector model, which is one of the most basic design consisting of just two sectors: people or families as well as organizations. In the two-sector design, it is presumed that households invest all their earnings as customer expenditures and buy the goods and also solutions created by companies. Therefore, there are no tax obligations, cost savings, or financial investments that are related to various other industries in circular model.

Three-Sector Design

In the three-sector version, the government is included in the two-sector design. In this model, money moves from houses and organizations to the government in the form of taxes. The federal government repays in the form of government expenditures with subsidies, benefit programs, public services, and so on.

Four-Sector Design

The four-sector model consists of the international industry, which is also called the abroad field or external sector. The overseas market turns a shut economic climate into an open economic situation. It is linked to the various other industries with two flows of money: international trade (imports as well as exports) as well as foreign exchange (inflow and outflow of resources). Like the various other fields, each flow of cash is coupled with a flow of a variable of manufacturing or items as well as solutions.

Five-Sector Design

The fifth sector– the monetary field– is included in complete the circular flow version. It consists of financial institutions and also various other organizations that provide borrowing as well as borrowing solutions to the other fields.

Cost savings and financial investments are assumed in the five-sector version, which stream from other industries with residual money into the banks, after that bent on the sectors that need cash. As long as financing (injection) amounts to borrowing (leakage), the round circulation gets to a balance and can continue permanently.

Ramifications of the Circular Flow Model

As a fundamental idea of macroeconomics, the round flow model has been extensively used in different researches, with significant effect on the understanding of economics. Four examples are listed below to reveal the value of the model.

Dimension of national earnings: The industries in the circular flow model are the components of the estimation of nationwide income. The expenditure method calculates a country’s GDP as the amount of the family intake expenses, private residential financial investment, government usage and financial investment expenditures, and also internet exports (GDP = C + I + G + [X-M].

Knowledge of connection: The circular circulation version underpins the expertise of interdependence in between sectors in an economic system. The tasks and cash flows can not happen without communication with one more market.

Incessant nature of financial activities: Cash and financial sources circulation in cycles indefinitely with a balance of aggregate income and expenditures.

Injections as well as leakages: The circular circulation of an economic climate is balanced when the overall shots equate to the leakages. If injections overweight leakages, the country’s national earnings will certainly grow. If injections are listed below leaks, the national earnings will certainly reduce.

TRICK TAKEAWAYS

The round circulation model shows how cash relocates from producers to households and back again in an unlimited loop. In an economic climate, cash moves from manufacturers to employees as incomes and after that back from workers to producers as workers spend cash on product or services.

The models can be made a lot more intricate to consist of additions to the money supply, like exports, and also leakages from the money supply, like imports.

When every one of these elements are completed, the result is a country’s gdp (GDP) or the national earnings. Analyzing the round circulation model and its current influence on GDP can assist federal governments and central banks adjust financial as well as fiscal policy to enhance an economy.

My Name is Nadeem Shaikh the founder of nadeemacademy.com. I am a Qualified Chartered Accountant, B. com and M.Com. having professional and specialize experience in field of Account, Finance, and Taxation. Total experience of 20 years in providing businesses solution in Taxation, Accounting, and Finance with all statutory compliance with timely business performance Financials reports. You can contact me on nadeemacademy2@gmail.com or contact@nadeemacademy.com.