What is Income Tax Rebate under section 87A ?

A rebate under section 87A is considered one of the income tax provisions that help taxpayers reduce their income tax liability. In a financial year, you can also claim an income tax rebate under section 87A if your total income is not able to exceed 5 lakh INR. Your income tax liability can becomes nil after claiming the rebate under section 87A.

Steps for claiming a Income Tax Rebate under section 87A:

- For the financial year calculate your total gross income

- Lower your tax deductions for tax savings, investments etc.

- Reach at your total income after lowering the tax deductions.

- File an income tax return by declaration of your gross income and tax deductions.

- Claiming a tax rebate under the section 87A if your total income does not exceed 5 lakh INR.

- The highest rebate under section 87A for the AY 2020-21 is 12,500 INR.

Calculation of rebate under a section 87A is basically in the case of an individual for whose age is below 60 years for AY 2020-21:

| Source of income (FY 2019-20) | Income (INR) |

| Gross total income | 7,50,000 |

| Less: Deduction under section 80C | 1,50,000 |

| Total income | 6,00,000 |

| Income-tax (@ 5% from 2.5 lakh INR to 5 lakh INR) | 12,500 |

| Less: Rebate u/s 87A | 12,500 |

| Tax payable | Nil |

*You can also claim deductions under the section 80C for tax-saving, 80D for insurance regarding medical, 80CCD for contribution to National Pension Scheme, 80G for various donations and several other deductions for arriving at your total income.

Things to keep in mind for availing rebate under the section 87A:

-

The rebate can also be applied to the total tax before adding 4% of cess to health and education.

-

Only those individuals who are residents are eligible can avail rebate under this section.

-

People who are above 60 years and below 80 years of age are considered as Senior Citizens can also avail for rebate under section 87A.

-

People whose age is above 80 years are considered as Super Senior Citizen are not eligible to claim rebates under section 87A.

-

The amount of rebate will be lower than the limit which is specified under the section 87A or total income tax which is payable (before cess).

-

Section 87A rebate is also available under old tax regimes as well as new tax regimes.

Eligibility for claiming rebate u/s 87A for FY 2020-21 and 2019-20:

You can claim for the benefit of rebate under section 87A for FY 2020-21 and 2019-20, which are subjected to the following conditions which are satisfied:

-

You are a resident individual.

-

After lowering the deductions under chapter VI-A (Section 80C, 80D and so on), your total income does not exceed 5 lakh INR in an FY.

The tax rebate is limited to 12,500 INR. It means, if your total tax payable is less than 12,500 INR, then you wouldn’t have to pay any kind of tax.

Note: That the rebate can be applied to the total tax before the addition of 4% of the health and education cess.

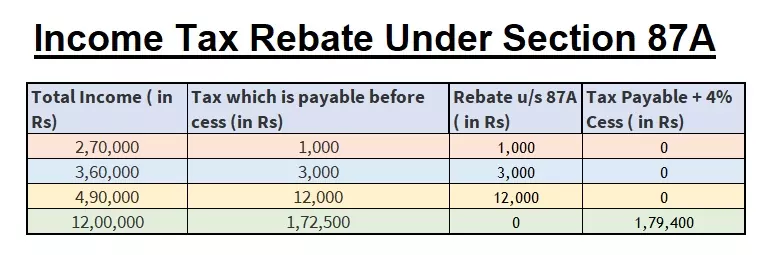

Few examples of section 87A rebates for those individuals who are residents, including senior citizens:

| Total Income (INR) | Tax payable before cess (INR) | Rebate u/s 87A (INR) | Tax Payable + 4% Cess (INR) |

| 2,70,000 | 1,000 | 1,000 | 0 |

| 3,60,000 | 3,000 | 3,000 | 0 |

| 4,90,000 | 12,000 | 12,000 | 0 |

| 12,00,000 | 1,72,500 | 0 | 1,79,400 |

Eligibility for claiming the rebate u/s 87A for FY 2018-19 and 2017-18:

In case, if you are filing income tax returns for FY 2017-18 or 2018-19, the eligibility criteria for claiming the tax rebate under section 87A are as follows-

- You are an individual who is considered as Resident.

- Your total income after the deductions under chapter VI-A (Section 80C, 80D, 80E and so on) is less than 3.5 lakh INR.

The amount of the tax rebate is limited to 2,500 INR. So, if your tax payable is not exceeding 2,500 INR, then you will not have to pay tax.

Note: That the tax rebate can be applied to the total tax before the addition of 4% of the health and education cess for FY 2018-19 or 3% of education cess FY 2017-18.

Here are some examples of section 87A rebates for resident individuals, including senior citizens for FY 2017-18 and FY 2018-19:

Total Income (INR) |

Tax payable before cess (INR) |

Rebate u/s 87A (INR) |

Tax Payable + 4% Cess (INR) |

| 2,65,000 | 750 | 750 | 0 |

| 2,70,000 | 1,000 | 1,000 | 0 |

| 3,00,000 | 2,500 | 2,500 | 0 |

| 3,50,000 | 5,000 | 2,500 | 2,500+cess** |

** Tax payable for FY 2017-18 will be 2575 INR i.e. 2500 INR + 3% cess and

tax payable for FY 2018-19 will be 2600 INR i.e. 2500 INR + 4% cess

Rebate limit under section 87A for all the financial years:

| Financial Year | Limit on Total Taxable Income | Amount of rebate allowed u/s 87A |

| 2021-22 | 5.00,000 INR | 12,500 INR |

| 2020-21 | 5,00.000 INR | 12,500 INR |

| 2019-20 | 5,00,000 INR | 12,500 INR |

| 2018-19 | 3,50,000 INR | 2,500 INR |

| 2017-18 | 3,50,000 INR | 2,500 INR |

| 2016-17 | 5,00,000 INR | 5,000 INR |

| 2015-16 | 5,00,000 INR | 2,000 INR |

| 2014-15 | 5,00,000 INR | 2,000 INR |

| 2013-14 | 5,00,000 INR | 2,000 INR |

Frequently Asked Questions:

Can NRIs is permitted to claim a rebate under section 87A?

No, this rebate is only allowed for those who are resident individuals. Therefore, a taxpayers will be qualifying as non-residents are bascially not eligible for a rebate under 87A.

Can anyone claim this Income Tax Rebate?

This rebate is only being allowed for those who are individuals, a HUFs or a firms, or companies cannot claim this rebate. So remember on filling of Income tax Return.

What is the procedure to claim rebate u/s 87A?

Only resident individuals are able to claim tax rebate u/s 87A, which means HUF and firms cannot claim this rebate.

This rebate can be claimed while filing an ITR return. For FY 2019-20, If you are paying self-assessment tax and your income is less than 5 lakh INR after claiming deductions under Chapter VI-A, you can claim a total tax rebate of up to 12500 INR.

If your income is subject to TDS, but your total income after chapter VI-A deductions is much lesser than VI-A, you can claim rebate u/s 87A while filing the return, and you would receive a refund of TDS which is paid up to 12,500 INR.

How to calculate Income Tax Rebate u/s 87a?

Section 87A provides tax rebates to the individual taxpayers if their total income is less than 5 Lakhs INR after claiming deductions. Hence, firstly if taxable income after all deductions is to be determined is to check the eligibility of the rebate. Before the due date of filling return.

Calculate your total gross income and reduce deductions under section 80C to 80U. If the same is below 5 lakh INR, you are eligible for a tax rebate, i.e., total tax up to 12500 INR will be deducted per section 87A.

If taxable income Calculated is more than 5 lakh INR, then no rebate can be claimed.

My Name is Nadeem Shaikh the founder of nadeemacademy.com. I am a Qualified Chartered Accountant, B. com and M.Com. having professional and specialize experience in field of Account, Finance, and Taxation. Total experience of 20 years in providing businesses solution in Taxation, Accounting, and Finance with all statutory compliance with timely business performance Financials reports. You can contact me on nadeemacademy2@gmail.com or contact@nadeemacademy.com.