Income tax can be levied on the income earned by all the individuals, Hindu Undivided Family (HUF), various partnership firms, LLPs, and Corporates as per the Income-tax Act of India. In the case of an individual, tax is applied as per the slab system if their income is more than the minimum threshold limit (known as the basic exemption limit).

What is the Income Tax Slab for AY 2020-21?

Typically, Indian Income-tax levies tax on individual taxpayers, based on a slab system. A slab system means different tax rates which are prescribed for various income ranges. It also means that the tax rates keep increasing with an increase in the payment of the taxpayer. This type of taxation helps in enabling progressive and fair tax systems in the country. Such income tax slabs tend to change every budget.

These slab rates can be different for different categories of taxpayers. Income tax has been classified into three types of “individual “taxpayers such as:

- Citizens who are less than 60 years of age. It includes both the residents and the non-residents.

- Senior citizens who are counted as residents (60 years to 80 years of age).

- Resident Super senior citizens whose age is more than 80 years.

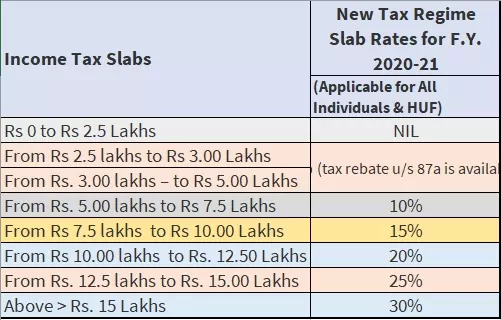

Income Tax Slab Rates for the FY 20-21 (AY 2021-22):

-

Slab rate for New Tax regime of FY 2020-21 and Why is it optional?

In this new regime, taxpayers have the option for choosing from either :

- As per New tax regime, paying income tax at lower rates on the condition that they can forgo certain permissible exemptions and also several deductions are also available under income tax; or

- To continue to pay taxes under the current tax rates. The assessed can also avail of rebates and exemptions by staying in the old regime and paying tax at the current higher rate.

NOTE:

- Please note that the tax rates mentioned in the New tax regime are considered identical for all categories of citizens, i.e., Individuals & Hindu Undivided families whose age is 60 years, Senior citizens who are above 60 years or up to 80 years, and Super senior citizens above 80 years. Hence no increased essential exemption limit benefit will be available to old and super senior citizens in the New Tax regime.

- Citizens whose net taxable income is less than or even equal to 5 lakh INR can have the eligibility for tax rebate u/s 87A, i.e., the tax liability can be nil of such citizen in both new and old existing tax regimes.

- The limit for basic exemption for NRIs is 2.5 Lakh INR can be irrespective of age.

- Additional cess of Health and Education can be at the rate of 4 %, which is added to the income tax liability in all possible cases. (which have been increased from 3% since FY 18-19)

- Surcharge applicable as per the tax rates below in all categories are mentioned above:

- If total income is> 50 lakh INR, then 10% of income tax is applicable.

- If total income > 1 crore INR, then 15% of income tax is applicable.

- If total income is> 2 crore INR, then 25% of income tax is applicable.

- If total income is> 5 crore INR, then 37% of income tax is applicable.

The slab of the Income-tax rate for the Old Tax regime -FY 2020-21

NOTE:

- Exemption of Income tax is limited up to 2,50,000 INR for Individuals, HUF who are below 60 years of age and even NRIs for FY 2018-19

- 4% additional health & education cess will be applicable on the tax amount, which is calculated as above.

- Surcharge:

- 10% of income tax is applicable where the total income exceeds 50 lakh INR up to 1 crore INR.

- 15% of income tax is applicable where the total income is exceeding 1 crore INR.

Difference between of slab rates between New tax regime & Old Tax regime.

Conditions for opting New Tax regime.

The taxpayer who is opting for concessional rates in the New Tax regime would have to forgo certain exemptions and several deductions available in the existing old tax regime.

Total there are 70 deductions & exemptions that are not allowed, out of which the most commonly used deductions and exemptions are mentioned below:

| List of common Exemptions and deductions “ not allowed” under New Tax rate regime | List of deductions “allowed” under new Tax rate regime. |

| Leave Travel Allowance (LTA) | Transport allowance for specially abled people |

| House Rent Allowance (HRA) | Conveyance allowance for expenditure incurred for travelling to work. |

| Conveyance allowance. | Investment made in a Notified Pension Scheme under section 80CCD(2). |

| Daily expenses in the course of employment | Deduction for an employment of a new employees mention under section 80JJAA |

| Relocation allowance | Depreciation u/s 32 of a Income-tax act which is except additional type of depreciation. |

| Helper allowance | Any allowance for travelling for employment or on transfer. |

| Children education allowance | |

| Other special allowances [Section 10(14)] | |

| Standard deduction on salary | |

| Professional tax | |

| Interest on housing loan (Section 24) | |

| Deduction under Chapter VI-A deduction (80C,80D, 80E and so on) (Except Section 80CCD(2)) |

Example for proving which one is better Old Tax regime or New Tax regime:

The new tax regime can primarily benefit middle-class taxpayers with a taxable income of up to 15 lakh INR. The old regime is considered as the better option for those earners who are having a high income.

The new income tax regime can also be beneficial for those people who are making low investments. As the new administration offers seven lower income tax slabs, anyone paying taxes without claiming tax deductions can benefit from paying a lower tax rate under the new tax regime.

For instance, the assessee having total income before deduction up to 12 lakh INR would be having higher tax liabilities under the old system if they have investments less than 1.91 lakh INR. Therefore, if you are investing less in tax-saving schemes, then go for the new regime.

It shows that if you already have a place in the financial plan for wealth creation by making investments in tax-saving instruments; medical and life insurance; concluding payments of children’s tuition fees; payment of education loan as EMIs; purchasing a house under a home loan scheme; and so on, the old regime can also help you with deductions in higher tax and lower tax outgo.

As we have seen above and considered the new income tax regime, if taxpayers opt for the concessional tax rates, they may evaluate both governments. Hence, it can be advisable to do a comparative evaluation and even analysis under both the regimes and then choosing the most beneficial one as it might vary from individual to individual.

E.g., if the comparison is made between the Old & New tax regime of an assessee with an income of 10 Lakh INR.

Mr. Rajiv is having a salary income of 10 lakh INR. His total investment u/s 80C is 1.7 lakh INR under Equity Linked Savings Scheme, Provident Fund, LIC premium, and some principal installment amount of home loan. Further, he can also pay Medical insurance for himself and his wife of 28000 INR.

If he wants to opt for the old tax regime, he can claim the above deductions; however, these deductions will not be available if he wishes to go for a new tax regime. He has paid a home loan interest of 75000 INR in FY 20-21.

As per the above illustration, if the gross income is more than Rs 10 lakh or deductions made u/S 80C, 80D, and even 24(b) of the Income Tax Act are available, the older regime is more beneficial from the standpoint of tax planning. While an individual from the middle-income group can earn a gross income of 5 lakh INR, the new tax slab regime might prove advantageous.

Time of Selection of the option of old vs. new regime?

Nature of Income

Time of Selecting the option of old regime vs. new regime

Income earned from the Salary or any other source of income that is attracting TDS

An employee can also choose the new tax regime and intimate their employer at the start of FY 2020-21. Employees can also change the option of selection of the tax regime every year

However, if the new tax slab regime has opted at the beginning of the year, it can’t be changed anytime during the year for TDS purposes; however, the option can be changed when filing of Income-tax return.

Income from Business & Profession

In the case of Business or professional income, the option for choosing between the tax regimes is available only one time for a particular business.

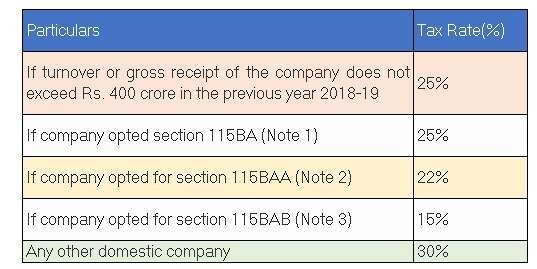

Slab Rates of New Tax regime for domestic companies – FY 2020-21.

- Health and Education can have additional cess at the rate of 4 % added to the income tax liability in all cases.

Surcharge applicable for companies is as below:

7% of Income-tax where total income > 1 crore INR.

12% of Income-tax where total income > 10 crore INR.

10% of a income tax where a domestic company opted for mention in section 115BAA and 115BAB.

- The income tax rate for Partnership firm or LLP as per old/ new regime.

A partnership firm/ LLP is taxable at 30%.

12% Surcharge is levied on incomes above 1 crore INR. On the other side, Health and Education cess at the rate of 4 %

Note- There are no concessional rates introduced for firms / LLPs in the new tax regime

My Name is Nadeem Shaikh the founder of nadeemacademy.com. I am a Qualified Chartered Accountant, B. com and M.Com. having professional and specialize experience in field of Account, Finance, and Taxation. Total experience of 20 years in providing businesses solution in Taxation, Accounting, and Finance with all statutory compliance with timely business performance Financials reports. You can contact me on nadeemacademy2@gmail.com or contact@nadeemacademy.com.