What is the profit margin formula?

The most commonly used profitability ratio is the profit margin used to measure how a company or a business activity is making money. It also represents what percentage of sales have turned into profits.

The percentage figure will indicate how many cents of profit the business has been generated for each dollar of sale. For instance, if a business is reporting that it achieved a 35% profit margin during the last quarter, it had a net income of $0.35 for each dollar of sales generated.

There are several types of profit margins. However, in everyday use, it usually refers to the net profit margin. After all the other expenses, including taxes and one-off oddities, a company’s bottom line has been taken out of revenue.

What are the net profit margin and its formula? Let’s now consider net profit margin, which is the most significant of all the measures—and what people usually mean when they ask, “what’s the company’s profit margin.”

Net profit margin is also calculated by dividing net sales by net sales or dividing net income by revenue realized over a given period. In the context of profit margin calculations, the net profit and net income are also used interchangeably. Similarly, sales and revenue can be used interchangeably.

Net profit is determined by deducting all the associated expenses, including costs towards raw material, labor, operations, rentals, interest payments, and taxes, from the total revenue generated.

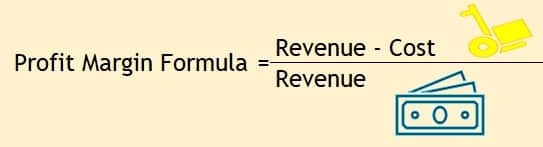

FORMULA PROFIT MARGIN FORMULA:

NET PROFIT MARGIN = SALES REVENUE LESS COST / REVENUE

What are the basics of the profit margin formula?

Businesses and individuals across the global platform perform for-profit economic activities for generating profits. However, absolute numbers—like X million USD worth of gross sales, Y thousand USD business expenses, or Z USD earnings—fail to provide a clear and realistic business” profitability and performance picture.

Several other quantitative measures are used to compute the gains (or losses) a business generates, making it easier to assess the performance of a business over different periods or compare it against competitors. These measures are called profit margins.

Some proprietary businesses, like local shops, maybe computing profit margins at their own desired frequency (like weekly or fortnightly), large businesses, including listed companies, must report it following the standard reporting timeframes like quarterly or annually.

Businesses that are or may be running on loaned money can be required for computing and reporting it to the lender like a bank every month as a part of standard financial procedures.

There are usually four levels of profit or profit margins: gross, operating, pre-tax, and net profit. We can see the reflection of these margins on a company’s income statement in the following sequence: A company takes in sales revenue, then pays direct costs of the product or service. What’s left is the gross margin.

Then it makes the payments of indirect costs like company headquarters, advertising, and research and development. What’s left is the operating margin. Then it makes payment of interest on debt and adds or subtracts any unusual charges or inflows unrelated to the company’s main business with a pre-tax margin left over.

Then it pays taxes by leaving the net margin, also known as net income, which is the very bottom line.

What are the types of profit margin and their formula?

Below mentioned 3 points are the types of profit margin:

Gross profit margin: Starting with the sales and take out costs directly related to creating or providing the product or service like raw materials, labor, and so on—typically bundled as “cost of goods sold,” cost of products sold,” or” “cost of sale” on the income statement—and you get the gross margin.

On a product basis, gross margin is most useful for analyzing its product suite (though this data isn’t shared with the public). Still, aggregate gross margin does show a company’s rawest profitability picture.

Gross profit margin FORMULA

Gross profit margin: GROSS SALES LESS DIRECT COST / GROSS SALES

Operating Profit Margin

Operating Profit Margin can say operating margin: By deducting selling, general and administrative, or operating expenses from a company’s gross profit number, we get operating profit margin, known as earnings before interest and taxes, or EBIT. It results in an income figure that’s available to pay the business” debt and equity holders, as well as the tax department, its profit from a company’s main, ongoing operations. Bankers and analysts frequently use it to value an entire company for potential buyouts.

FORMULA:

Pretax Profit Margin formula = Net Profit before Tax / Sales

Pretax profit margin formula : Take operating income and subtract interest expense while adding any interest income, adjusted for non-recurring items like gains or losses from discontinued operations, and you’ve got pre-tax profit, or earnings before taxes (EBT); then divide by revenue, and you’ve got the pre-tax profit margin formula.

The significant profit margins are all comparable to some level of residual profit to sales. For instance, if there is a 42% gross margin for every 100 USD in revenue, the company pays 58 USD in costs directly connected to producing the product or service, leaving 42 USD gross profit.

Analysis of Profit margin formula

The profit margin ratio can directly measure what percentage of sales can be made up of net income. In other words, it can measure that how much profits are produced at a certain level of sales.

This ratio can also indirectly measure how well a company can manage its expenses relative to its net sales. That is why companies are striving to achieve higher ratios. They can generate more revenues, keep expenses constant, or keep revenues constant and lower expenses.

Since generating additional revenues is much more difficult than cutting expenses, managers generally tend to reduce spending budgets to improve their profit ratio.

Like most profitability ratios, this ratio is best used to compare sized companies in the same industry. This ratio is also effective for measuring the past performance of a company.

Analysis Number 2 of profit margin formula

As we look at the formula, it indicates that profit margin is derived from two numbers sales and expenses. For maximizing the profit margin, we have to calculate as {1 – (Expenses/ Net Sales)}, one will look to minimize the result which is achieved from the division of (Expenses/Net Sales).

That can be achieved when we see that the Expenses are low and credit sales are higher. Now let’s understand it by expanding the above base case example.

If the same business is generating the same amount of sales worth 100,000 USD by spending only 50,000 USD, its profit margin will come to {1 – 50,000 USD/100,000 USD)} = 50%. If the costs for generation the same sales is further reduced to 25,000 USD, the profit margin will shoot up to {1 – 25,000 USD/ 100,000 USD)} = 75%. In summary, reducing the costs will help to improve the profit margin.

On the other hand, if the expenses have been kept fixed at 80,000 USD and sales are improved to 160,000 USD ,profit margin will rise to {1 – 80,000 USD/ 160,000 USD)} = 50%. Further raising the revenue to 200,000 USD with the same expense amount which will lead to profit margin of {1 – 80,000 USD/200,000 USD)} = 60%. In summary, it will increase sales, which will also bump up the profit margins.

Based on the above examples, it can be generalized that it can improve the profit margin by increasing sales and reducing costs. Theoretically, can achieve higher sales by increasing the prices or increasing the volume of units sold. Practically, if the price rise is possible only to the extent of not losing the competitive edge in the marketplace.

At the same time, sales volumes remain dependent on market dynamics like overall demand, percentage of market share commanded by the business, and competitors” existing position and future moves. As same, the scope for cost controls also has its limits. One may reduce or eliminate a non-profitable product line for curtailing expenses, but the business will also lose out on the corresponding sales.

It has also become a fine balancing act for the business operators for adjusting pricing, volume, and cost controls in all scenarios. Essentially, the profit margin can act as an indicator of a business owner’s” management’s adeptness in implementing pricing strategies that lead to higher sales and efficiently controlling the various costs to keep them minimal.

Usage of profit margin formula

From an expensive publicly listed company to an average sidewalk stall, the profit margin can be figured widely using and quoted by all kinds of businesses worldwide. Beyond individual businesses, can also use it to indicate the profitability potential of larger sectors and overall national or regional markets. It is also commonly seen in headlines like “ABC Research has warned on declining profit margins of Countries auto sector” or” “other corporate profit margins can break out.”

In essence, the profit margin can become the globally adopted standard measure for the profit-generating capacity of a business and is a top-level indicator of its potential. One of the first few keys to figuring out the quote is that companies have issued quarterly results reports.

Internally, the business owners, company’s management, and external consultants address operational issues and study seasonal patterns and corporate performance during various timeframes. A zero or negative profit margin can be translated for a business struggling to manage its expenses or failing to achieve good sales.

A further drill-down will help to identify several leaking areas like highly unsold inventories, excess yet underutilized employees and resources, or higher payable rent and then devising appropriate action plans. Enterprises operating multiple business divisions, various product lines, stores, or geographically spread-out facilities may use profit margins to assess each unit’s performance. They can compare them against one another.

Profit margins can often come into play when a company seeks funding. Like a local retail store, individual businesses may need to provide it for seeking or restructuring a loan from banks and other lenders. It has also become important while taking out a loan against a business as collateral.

Large corporations issuing debt for raising money are required to reveal their intended use of collected capital. It provides insights to investors about the profit margin that can be achieved either by cost-cutting or increasing sales or combining both. This number has become an integral part of equity valuations for the primary market for initial public offerings (IPO).

Finally, profit margins can also be a significant consideration for the investors. Investors who look to fund a particular startup may likely assess the profit margin of the potential product or service being developed. While comparing multiple ventures or stocks to identify the better one, investors often hone in on the respective profit margins.

Examples of High-profit margin Industries-

Businesses of luxury goods and high-end accessories often operate on high-profit potential and low sales. Few costly items, like a high-end car, are ordered to build. The unit is manufactured after securing the order from the customer, making it a low-expense process without many operational overheads.

Software or gaming companies may invest initially while developing a particular software/game and cash in big later by simply selling millions of copies with very little expense. Getting into strategic agreements with device manufacturers, like offering pre-installed Windows and M.S. Office on Dell-manufactured laptops, further reduces the costs while maintaining revenues.

Patent-secured businesses like pharmaceuticals may incur high research costs initially, but they reap big with high-profit margins while selling the patent-protected drugs with no competition.

Examples of Low-profit margin formula for Industries

Operation-intensive businesses like transportation which may have to deal with fluctuating fuel prices, drivers” perks and retention, and vehicle maintenance usually have lower profit margins.

Agriculture-based ventures usually have low-profit margins owing to weather uncertainty, high inventory, operational overheads, need for farming and storage space, and resource-intensive activities.

Automobiles also have low-profit margins, as profits and sales are limited by intense competition, uncertain consumer demand, and high operational expenses involved in developing dealership networks and logistics.

What is a good profit margin formula?

A good margin can vary considerably by industry. Still, as a general rule, a 10% net profit margin is considered average, a 20% margin is considered high (or” “goo”), and a 5% margin is low. Again, these guidelines vary widely by industry and company size and can be impacted by various other factors.

How is the profit margin affecting the economy?

The profit margin is critical to a free-market economy while driven by capitalism. The margin must be high enough while comparing with similar businesses to attract investors. Profit margins, in a way, helps to determine the supply for a market economy. If a product or service does not create a profit, companies will not supply it.

Profit margins are the main reason for companies outsourcing jobs because workers from the United States are more expensive than any other workers in several other countries.

Companies want to sell their products at very competitive prices and also want to maintain reasonable margins. To keep sales prices low, they must move their jobs to cut the cost of workers in Mexico, China, or other several foreign countries.

These profit margins can also assist companies in creating pricing strategies for various products or services. Companies usually base their prices on producing their products and the amount of profit they are trying to turn.

For example, retail stores want to have a 50% gross margin to cover distribution costs plus return on investment. That margin is called the keystone price. Each entity involved in getting a product to the shelves doubles the price, leading retailers to the 50% gross margin to cover expenses.

Frequently Asked Questions-

What is the profit margin ratio?

Profit margin is the most commonly known profitability ratio to gauge how a company or a business activity makes money. Simply put, the percentage figure indicates how many cents of profit the business has generated for each dollar of sale.

What is the gross profit margin ratio?

The gross profit margin ratio can indicate the percentage of sales revenue a company keeps after it covers all direct costs associated with running the business. Gross profit margin basically calculated by subtracting direct expenses from net revenue, dividing net revenue, and multiplying by 100%.

What is the operating profit margin ratio?

Operating Profit Margin is profitability or the performance ratio that usually reflects the percentage of profit a company produces from its operations before deducting taxes and interest charges. It is basically calculated by just dividing the operating profit by total revenue.

What is the pretax profit margin?

The pretax profit margin is the financial accounting tool used for measuring a company’s operating efficiency. It is a ratio that tells us the percentage of sales that has turned into profits or, in other words, how many cents of profit the business has generated for each dollar of sale before deducting taxes.

My Name is Nadeem Shaikh the founder of nadeemacademy.com. I am a Qualified Chartered Accountant, B. com and M.Com. having professional and specialize experience in field of Account, Finance, and Taxation. Total experience of 20 years in providing businesses solution in Taxation, Accounting, and Finance with all statutory compliance with timely business performance Financials reports. You can contact me on nadeemacademy2@gmail.com or contact@nadeemacademy.com.